(This is an excerpt from an article I originally published on Seeking Alpha on July 7, 2015. Click here to read the entire piece.)

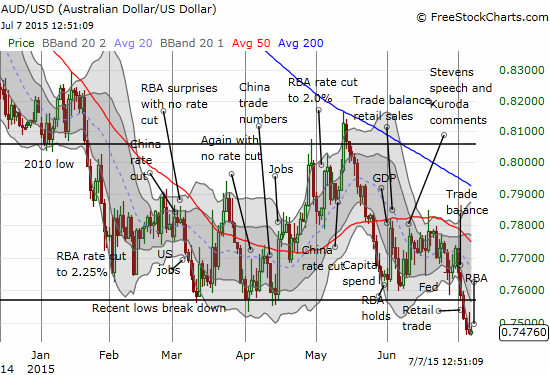

The Reserve Bank of Australia (RBA) left its cash rate at 2.0%, right in-line with market expectations as expressed through the Australian Stock Exchange’s RBA rate tracker. In making its policy statement for July, the RBA executed a copy and paste from the June statement and tweaked around the edges. {snip} Overall, the RBA statement is a non-event and should pave the way for some kind of relief bounce in the Australian dollar as I described earlier. The small caveat remains the RBA’s insistence that the Australian dollar should still go even lower.

{snip}

On the exchange rate, the RBA still sees further declines down the road for the Australian dollar (FXA). The related statement is a carbon copy from June. I had implicitly assumed that between 0.74 to 075 on AUD/USD might be good enough for the RBA. I am clearly wrong. This is just as well because the minute the RBA suggests it is satisfied with the level of the Australian dollar, the currency will surely soar as traders anticipate a bottom…

{snip}

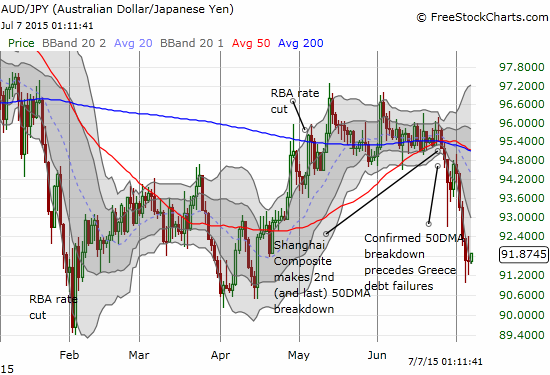

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 7, 2015. Click here to read the entire piece.)

Full disclosure: net long the Australian dollar