On Thursday night, May 21st, I observed the daily chart of the euro (FXE) and concluded it was ready for the next swoosh downward against the U.S. dollar. I posted this opinion on Stocktwits coincidentally at the same time someone else posted the exact opposite opinion.

Source: StockTwits.com

As it turned out, we were both correct. On a short intraday basis, “Jasonsignals” got a higher euro but it fell far short of the target. The “final” destination was the big swoosh lower as EUR/USD experienced convincing follow-through selling.

Source: FreeStockCharts.com

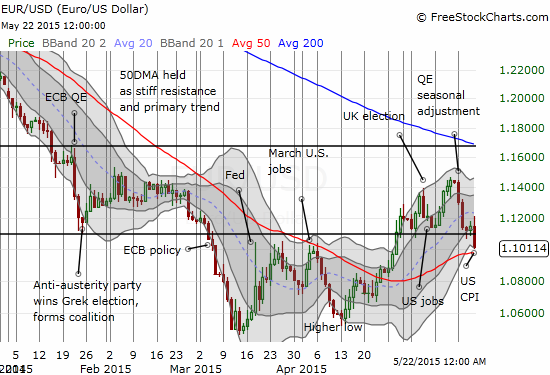

The key catalyst was a print on U.S. CPI that was ever so slightly higher than expectations. I was surprised by the depth of the reaction, even though it supported the message from the technicals. Note that on an intraday basis, a last warning sign came as the euro failed to surpass the high from the failed relief bounce from “swoosh #1.”

The next technical battle for EUR/USD rests at 1.10. Note how traders absolutely refused to let EUR/USD drop below that level going into Friday’s close. I can only imagine a lot of stops are sitting just below 1.10.

I finally closed out my short EUR/USD position on the first bounce away from 1.10. It was a large position, and I did not want to hold it for another weekend with such critical support on the line. I am sure I am not alone in preparing my next trade based on how well 1.10 holds up.

The next support for EUR/USD is at the 50-day moving average (DMA) right around 1.097. That support rests below the lower-Bollinger Band (BB), so I fully expect a rapid sequence for a lower euro: stops get taken out by longs to limit losses, the 50DMA get tagged maybe even surpassed, EUR/USD over-extends beyond the lower-BB, and the next bounce unfolds. I expect 1.11 to serve as stiff resistance all over again for such a bounce. If I am wrong to the downside – that is momentum takes the euro even lower without a bounce – the technical make-up becomes VERY bearish all over again for the euro.

Be careful out there!

Full disclosure: no position