(This is an excerpt from an article I originally published on Seeking Alpha on September 28, 2014. Click here to read the entire piece.)

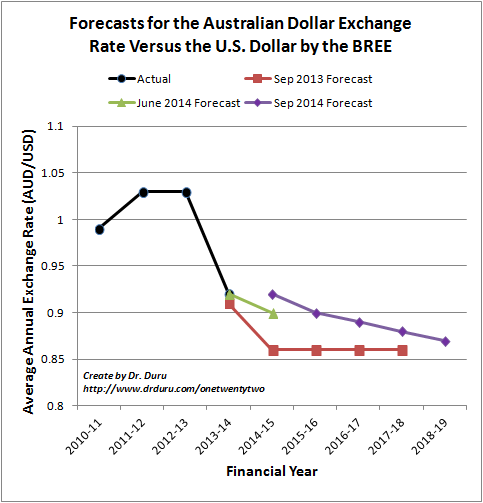

Australia’s Bureau of Resources and Energy Economics (BREE) recently released its September, 2014 quarterly report on Australia’s resources and energy sectors and analysis of key commodity markets. Each report includes forecasts for the Australian dollar (FXA). The September report includes an extended forecast. This year, the BREE has projected a much stronger Australian dollar than it did last year.

Source: Australia’s Bureau of Resources and Energy Economics (BREE)

{snip}

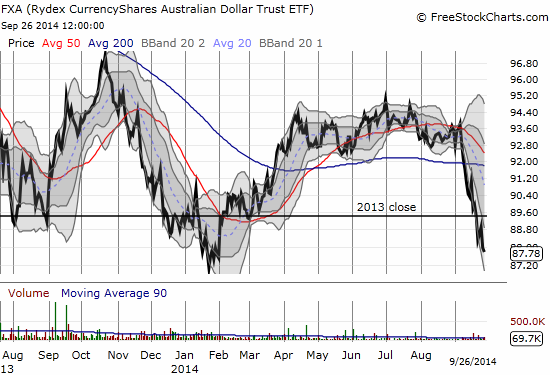

Source: FreeStockCharts.com

{snip}

The forecast of an average exchange rate of 0.92 means that the Australian dollar will experience a relatively strong rally in coming months and could of course trade back to the top of the year’s range. The BREE’s forecast for a slight annual decline in the average exchange rate suggest that the BREE overall expects the Australian dollar to continue exhibiting rangebound trading with a slight downward bias.

{snip}

The stubborn resilience of the Australian dollar in the year following that report has clearly convinced the BREE to hike its expectations of the exchange rate. {snip}

Deferring to the insights of the BREE means that this increase in expectations for the Australian dollar has important trading implications. First and foremost, the Australian dollar seems likely to survive a coming retest of 2014 lows. {snip}

Time will soon tell…

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 28, 2014. Click here to read the entire piece.)

Full disclosure: short Australian dollar