(This is an excerpt from an article I originally published on Seeking Alpha on September 29, 2014. Click here to read the entire piece.)

I have written before that home builders have focused on building for higher income buyers and mortgage financing has been restricted to the well-off. It turns out things are not quite as bad as I thought.

Last week, the U.S. Federal Reserve posted a pre-release of an article for its Bulletin called “The 2013 Home Mortgage Disclosure Act Data” (HDMA). Here is the Fed’s description of the HMDA:

{snip}

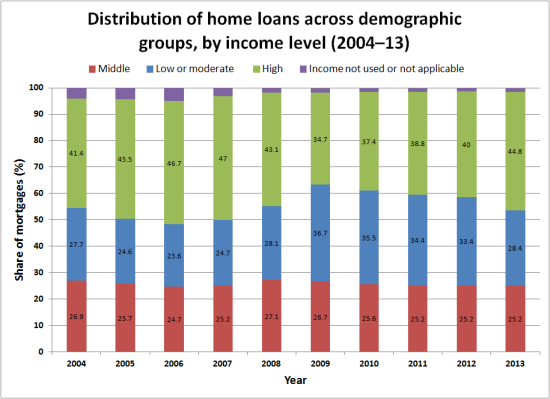

Source of data: U.S. Federal Reserve

The different colors in the stacked bars represent income levels defined as follows: “Low- or moderate-income borrowers have income that is less than 80 percent of estimated contemporaneous area median family income (AMFI), middle-income borrowers have income that is at least 80 percent and less than 120 percent of AMFI, and high-income borrowers have income that is at least 120 percent of AMFI.”

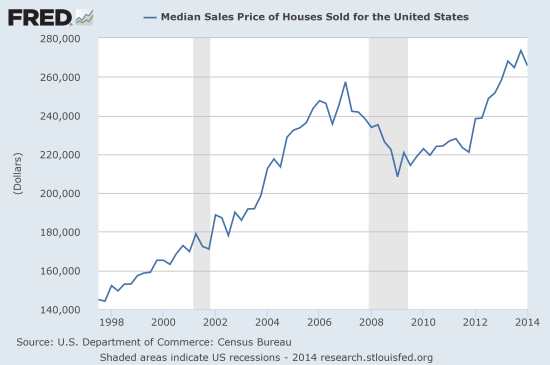

I placed the middle income demographic at the bottom of the bar because it has remained relatively steady over the ten years provided. {snip} Note that high income borrowers came back with a vengeance in 2013 as the median sales price of a U.S. home soared back to, and past, its pre-recession peak (note carefully that the chart below represents an aggregation across ALL homes sold):

Source: St. Louis Federal Reserve

{snip}

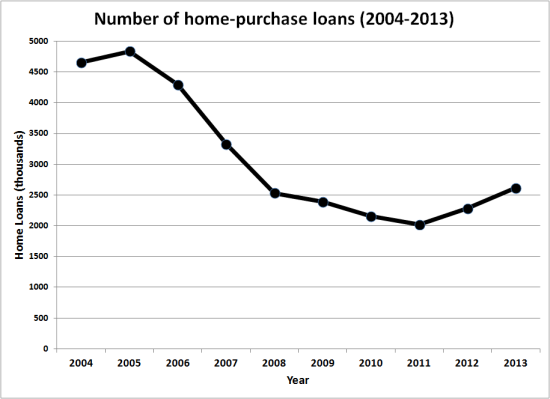

Source of data: U.S. Federal Reserve

The implications of the shift in income demographics for mortgages are difficult to determine with certainty without more detailed data. {snip}

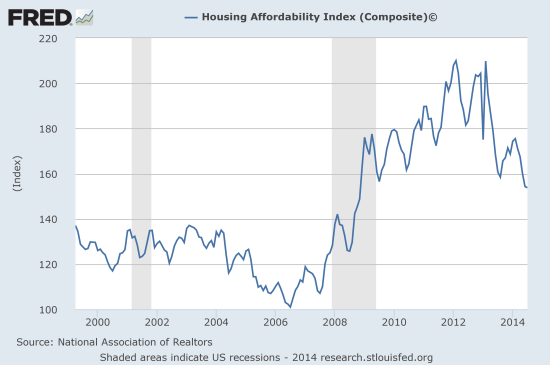

Source: St. Louis Federal Reserve

Be careful out there!

Full disclosure: no positions

(This is an excerpt from an article I originally published on Seeking Alpha on September 29, 2014. Click here to read the entire piece.)