(This is an excerpt from an article I originally published on Seeking Alpha on November 2, 2014. Click here to read the entire piece.)

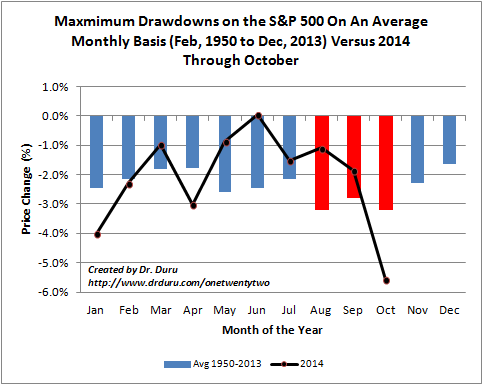

“A reason pretty much always exists to be bearish on the market. It just seems that from August to October, market participants are most willing and ready to listen to and act upon the siren calls.”

I concluded my last piece on S&P 500 correlations piece with this quote. This quote rings particularly true for the latest corrective phase of the market as sentiment swung wildly from worrying about nothing, to worrying about everything, to being completely relieved. {snip}

Source for price data: Yahoo! Finance

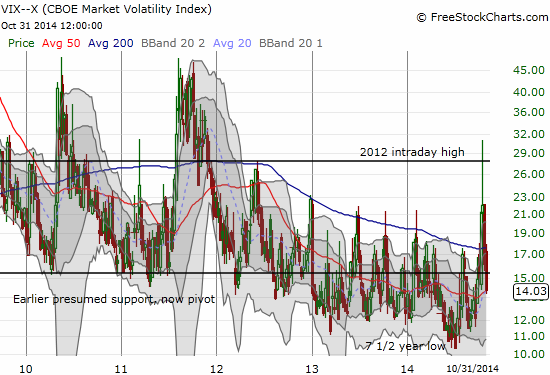

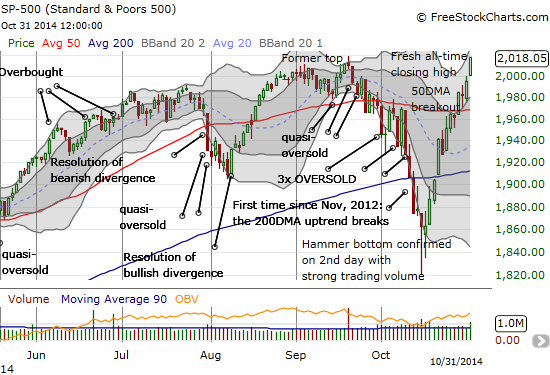

This year’s above-average October drawdown was characterized by a particularly extreme oversold period (as defined by the percentage of stocks trading below their 40-day moving averages (DMAs)). Even the percentage of stocks trading above their 200DMAs fell at one point to a 3-year low. Adding to the extremes were a volatility index that surged at one point past 2012’s high (but could not hold it for two days in a row) and an S&P 500 which quickly lost all its gains for the year.

Source: FreeStockCharts.com

The collection of extremes had me focused on the buying opportunities and formed the basis for my claim on October 17th that the stock market had finally carved out a bottom. Since then, I have been surprised at how nostalgic some bears seem for the sell-off, failing to credit the rapid healing in market sentiment that has enabled the S&P 500 to hit a fresh closing all-time high.

{snip}

Source: FreeStockCharts.com

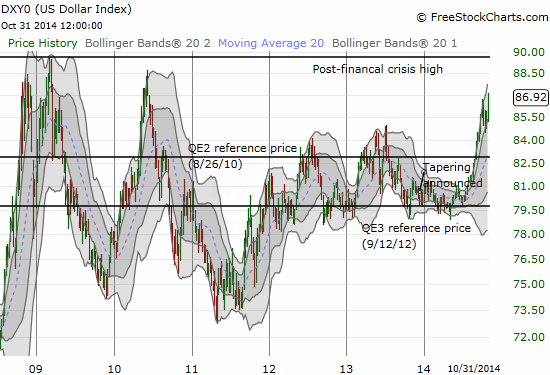

{snip} From this perspective, the market’s reaction to and ability to absorb an ever-stronger U.S. dollar (UUP) may be the key wildcard to track in coming weeks and months.

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long SSO

(This is an excerpt from an article I originally published on Seeking Alpha on November 2, 2014. Click here to read the entire piece.)