I am extending a hat tip to a friend who sent the following Seeking Alpha news alert on what must be the most bearish prediction on oil out there from a major analyst….

“The recent surge in oil prices is just a ‘head fake’ and West Texas crude as cheap as $20/bbl may soon be on the way, Citigroup warns as it again lowers its crude oil forecast. Despite declines in spending that have helped oil prices rebound in recent weeks, U.S. oil production is still rising, Brazil and Russia are pumping oil at record levels, and Saudi Arabia, Iraq and Iran have been fighting to maintain their market share by cutting prices to Asia, Citi’s Edward Morse says. Citi thinks a pullback in production isn’t likely until Q3, and in the meantime, WTI crude, which now trades at ~$52/bbl, could fall to $20 ‘for a while.'”

This assessment makes me think more and more that the dynamics sending oil ever lower are very similar to those sending iron ore ever lower in price. Citi’s conclusion is of course one reasonably sound argument among many describing a whole host of possible endgames, but it is exactly because this argument makes sense that I am taking notice. As I have mentioned in earlier posts, I highly doubt oil has already found its bottom…even as I am willing to trade as if oil is bottoming when it is near or at $40.

This bearish extreme is a great intro for quickly noting a change I made in my oil-related positioning today…

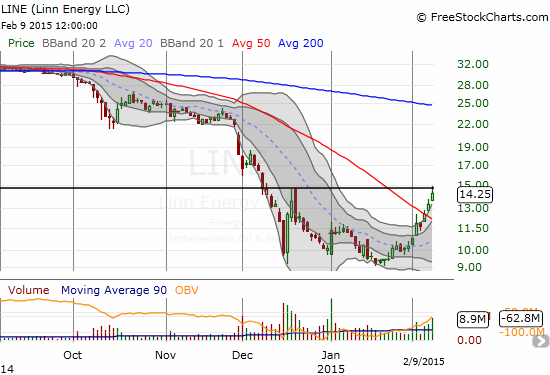

Linn Energy, LLC (LINE) traded as high as the high from its brief run-up in late December. Ironically, the December pop came as several analysts downgraded LINE and its brethren. I suppose traders figured the news had finally gotten as bad as it could get. Anyway, once I saw the fade from that presumed level of resistance, I decided to lock in my March call options. While I would love to continue holding on and use more of my time until expiration, the call options had soared over 4.5x in value in just 4 days. Rules are rules. Those are profits that must be secured. I will of course buy on dips and/or acquire a new (but smaller) position on a definitive breakout…depending on how overall market dynamics are playing out of course.

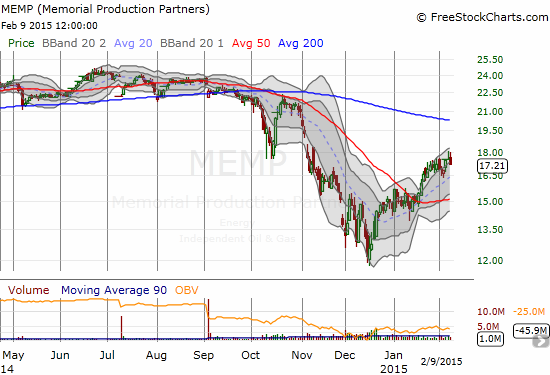

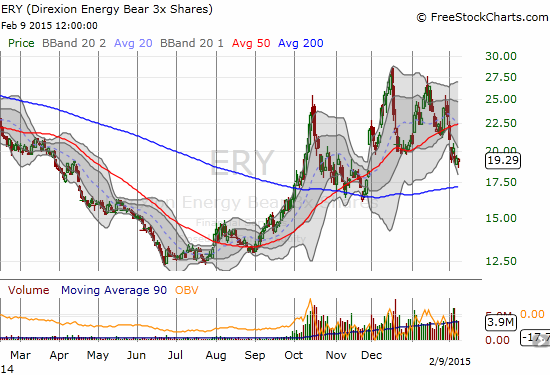

My long position in Memorial Production Partners LP (MEMP) stays for now, and my long position in Direxion Daily Energy Bear 3X ETF (ERY) definitely stays as an on-going hedge. The Citi downgrade makes this hedge all the more sensible. The position in MEMP was an idea I got from Nightly Business Report on December 5, 2014 because a guest on the show informed the audience that MEMP hedged out its production five years before the big decline despite a lot of criticism. (I now understand that this figure is more like an average of the hedging techniques MEMP uses). I cannot think of a better way to play oil when the best prospect is likely a trading range for the rest of the year.

Scroll the video below to 14:45 to see the guest, Greg Labella of Investment Partners Asset Management, provide a full analysis of the market at that time. He talks about MEMP at the 17:40 point. I owe this guy a HUGE thanks so far! Note that on top of the capital gain, MEMP is currently paying a 12.5% dividend yield that should hold up better than the high dividends in other less hedged MLPs .

Source for charts: FreeStockCharts.com

Be careful out there!

Full disclosure: long MEMP, long ERY

Late update: I sold out of MEMP in late March as the stock made its second breach of its 50DMA. Overall, momentum looked stalled and I did not want to hang around to see whether follow-through selling would ensue…especially since at the time I was afraid oil would trade lower at any moment.