After the market closed for trading on January 29, 2015, Intercept Pharmaceuticals (ICPT) released exciting news:

ICPT’s “…investigational product obeticholic acid (OCA) has received “breakthrough therapy designation” from the U.S. Food and Drug Administration (FDA) for the treatment of patients with nonalcoholic steatohepatitis (NASH) with liver fibrosis. This indication constitutes a population of patients with a serious and life-threatening condition reflected by a higher risk of progression to cirrhosis and liver failure. OCA is currently being developed for the treatment of several chronic liver diseases, including primary biliary cirrhosis (PBC), NASH and primary sclerosing cholangitis (PSC)…

…The breakthrough therapy designation was created by the FDA to speed the availability of new therapies for serious or life-threatening conditions. Drugs qualifying for this designation must show credible evidence of a substantial improvement on a clinically significant endpoint over available therapies, or over placebo if there is no available therapy. The designation confers several benefits, including intensive FDA guidance and discussion and eligibility for submission of a rolling NDA.”

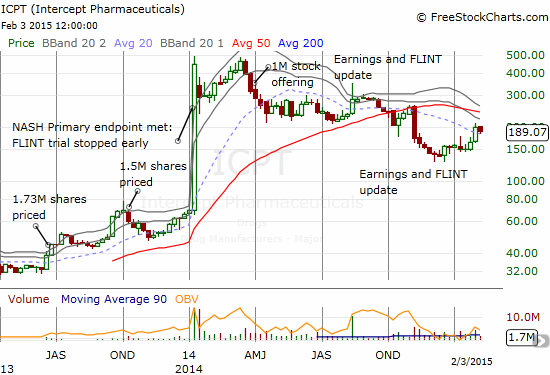

The stock responded the next day trading to a gain as high as 23% before settling for a 18% gain. That same day an analyst from Cowen and Company appeared on CNBC’s Fast Money to explain why ICPT is “absolutely a buy.” Responding to the host’s observation that investors have been burned in ICPT, the analyst explained that last year ICPT had to release drug development news according to the government’s schedule. This year and going forward, ICPT can provide a more controlled release schedule. I agree that a more controlled news flow should reduce volatility, but it of course does not guarantee that the released news will be good.

Despite the ringing endorsement, ICPT has proceeded to trade back to its high from three days before the news release. Although the previous two surges in the stock were met by immediate reversals, I was surprised by this latest fade. The stock was finally eating into its loss from a disastrous post-earnings response on November 7, 2014. I figured a retest of the 200-day moving average was around the corner for the short-term.

Source: FreeStockCharts.com

Perhaps the failure to maintain momentum was a result of traders anticipating ICPT using this opportunity to raise much needed cash. In the company’s last earnings report, the balance sheet showed cash and cash equivalents of $18M. Compare this to the $248M net loss in the nine months ended September 30, 2014 and the $55M net loss in the nine months ended September 30, 2013, and it is easy to see that the company needs to raise cash sometime early this year…at least to avoid selling the $255M in investment securities listed as “available for sale.” Almost on schedule, ICPT announced a public offering stock just four days after announcing the big FDA news:

ICPT “…has commenced an underwritten public offering of 800,000 shares of its common stock. All of the shares in the offering are to be sold by Intercept.

Intercept intends to use the net proceeds of this offering to support the expansion of its clinical, regulatory, medical affairs and commercial infrastructure in the United States and Europe, the clinical development program for obeticholic acid (OCA) in primary biliary cirrhosis (PBC), nonalcoholic steatohepatitis (NASH) and primary sclerosing cholangitis (PSC), the expansion of OCA manufacturing activities, advancement of INT-767 and other preclinical pipeline programs, and the preparation for and potential initiation of the commercial launch of OCA in PBC in the United States and certain European countries in 2016. The balance, if any, will be used for general corporate purposes.”

The book-running managers, Citigroup and RBC Capital Markets, have a 30-day option to buy up to 120K more shares. For reference, RBC defended ICPT on November 21, 2014, and on October 7, 2014 RBC reiterated an outperform rating with a $500 price target on the stock. On December 22, 2014, Citigroup issued a buy rating and a $475 price target.

This stock offering is definitely a good thing for funding the company. Traders/investors could become more encouraged to buy into ICPT with sufficient funding in place to get the company through the next round of approvals and trials. In the short-term, the issuance could mark a top in the stock. The last stock offering was announced on April 1, 2014 with the stock trading at $334:

ICPT “.. today announced that it has commenced an underwritten public offering of 1,000,000 shares of its common stock. 600,000 of the shares in the offering are to be sold by Intercept and 400,000 are to be sold by certain institutional selling stockholders.

Intercept intends to use the net proceeds of this offering to fund: work to support the company’s anticipated filings for marketing approval of obeticholic acid (OCA) in primary biliary cirrhosis (PBC) at the end of 2014; the long-term safety extension portion of the company’s POISE trial and its planned clinical outcomes trial in PBC patients; preparation for the potential commercial launch of OCA in PBC; continued development of OCA in NASH and conduct market research and pre-commercial activities in NASH; and expansion of the company’s infrastructure, including development and corporate personnel, to support the planned increased scale of its operations. The balance, if any, will be used for general corporate purposes. Intercept will not receive any proceeds from the sale of shares of common stock by the selling stockholders, including any sale of shares of common stock if the underwriters exercise their option to purchase additional shares of common stock from the selling stockholders.”

The offering was priced at $320. The money raised in this offering was clearly needed to fund the company for the remainder of the year given the tremendous burn rate demonstrated in the latest financials. Unfortunately for those shareholders who bought into the offering, ICPT has yet to close higher than its pricing. When the stock gapped up in response to earnings on August 12, 2014, sellers immediately knocked the stock back down from a high of $349 to a close of $276 – clearly, there were many motivated sellers at the level of the April offering. The same will likely be the case for this latest offering.

On the other hand, the offerings before the massive jump in early 2014, were lucrative for those shareholders willing to wait.

On June 24, 2013, ICPT announced a public offering of 1.73M shares at $33.01/share. The proceeds of the offering went directly to the company. At the time, the stock was in the middle of a rally that barely paused for the offering. On October 8, 2013, ICPT announced a public offering of 1.5M shares priced at $62.50/share. This offering was driven entirely by selling stockholders. At that time, the offering helped bring a sharp rally to an abrupt end. It took another month for the selling to finally bottom out.

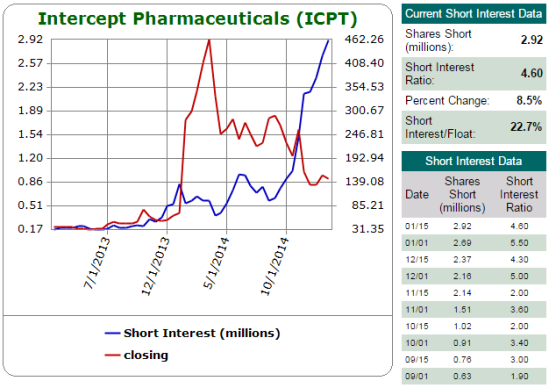

The biggest difference between “then” and now is market sentiment. In particular, shares short have soared in ICPT to 27% of its float. At the same time that shares short increased about 5x in the wake of August’s earnings, ICPT has lost about 54% of its value.

Source: Schaeffer’s Investment Research

The increasing divergence between analyst optimism with very high price targets and increasingly pessimistic short sellers presents a potentially explosive opportunity. While Cowen thinks that the odds favor a calmer stock this year, I look at this setup as one where news releases could send the stock collapsing by double digits in a flash or soaring like a rocket toward analyst price targets. No matter what amount of confidence is expressed in the science by analysts and others, there is enough uncertainty in the trial and approval process to put a jet pack (or pile driver) into any and every news release.

Without trying to take sides on how the odds will play out, I like a hedged play with shares traded in the direction of the short sellers and call options with the analysts. I like putting the leveraged side of the bet where I think there is more “room” to move. Given previous trading levels and analyst price targets, theoretically there is much more room to the upside. However, this also means that the short position is very small and well-protected by the call options. I may roll in and out of the position based on the technicals of the stock and the premiums on the options ahead of scheduled news releases like earnings.

Be careful out there!

Full disclosure: short ICPT shares and long call options