(This is an excerpt from an article I originally published on Seeking Alpha on December 18, 2014. Click here to read the entire piece.)

The Swiss National Bank (SNB) reacted swiftly.

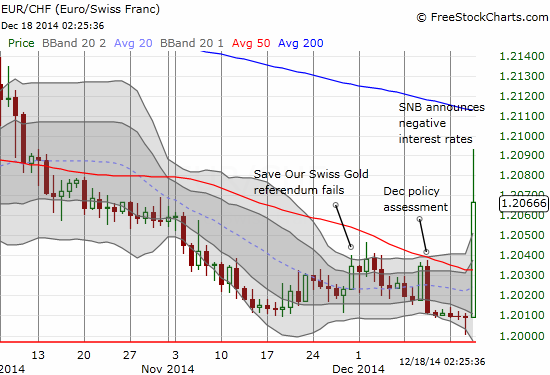

It could have just been a “fat finger” trade an hour before U.S. trading began. In an instant, the euro (FXE) vs Swiss Franc (FXF) currency pair (EUR/CHF) traded right down to the 1.20 floor before bouncing right back up in a flash.

Whatever it was, it was seemingly enough to kick the SNB into action. Early morning in Switzerland on December 18th, the SNB released the following news titled “Swiss National Bank introduces negative interest rates: Minimum exchange rate reaffirmed, and target range for three-month Libor lowered into negative territory“:

{snip}

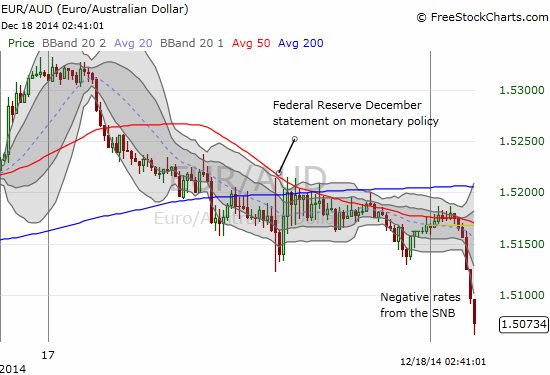

This announcement firmly reminds traders and investors that the currency markets are an important sphere of influence to monitor. {snip}

Source for charts: FreeStockCharts.com

Given my strategy to fade rallies in the euro, I have avoided buying EUR/CHF directly to play anticipated action from the SNB. {snip} Overall, I strongly expect the currency market to resist the SNB’s push to weaken the currency. That is, the journey from here to a weaker Swiss franc will not be a straight line. The market may even deign to force the SNB’s hand yet again.

Be careful out there!

Full disclosure: short the Swiss franc, net short the Australian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on December 18, 2014. Click here to read the entire piece.)