(This is an excerpt from an article I originally published on Seeking Alpha on December 30, 2014. Click here to read the entire piece.)

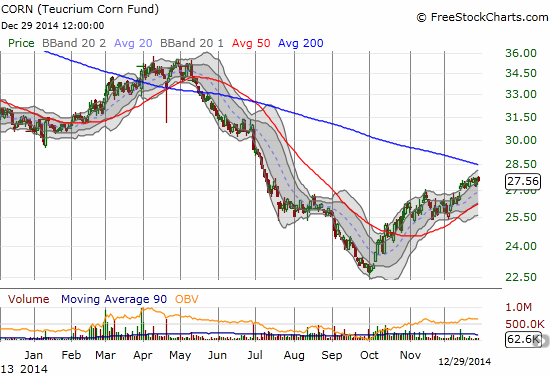

After an additional dip, my thesis for playing another bottom in Teucrium Corn ETF (CORN) seems to finally be working. Since that article in mid-August, CORN is up 5.3% versus a 6.0% gain in the S&P 500 (SPY). However, on the way to this gain, CORN first lost as much as 13%…so the ETF has a lot of work to do to balance out risk and reward.

Source: FreeStockCharts.com

As I continue to patiently wait for this trade to unfold, I occasionally check in on relevant news to support or refute the thesis of a supply correction coupled with on-going strength in demand. One of the more fascinating pieces I have read along these lines comes from the Economist on December 20, 2014 titled “Swine in China: Empire of the pig.” Before reading this piece, I had almost no understanding of the pig’s importance in Chinese history and diet. China’s increase in wealth in recent decades has simultaneously encouraged a massive increase in the consumption of pig meat:

{snip}

Be careful out there!

Full disclosure: long CORN

(This is an excerpt from an article I originally published on Seeking Alpha on December 30, 2014. Click here to read the entire piece.)