As soon as I noticed the unusually high options trading activity in Conn’s Inc. (CONN), I triggered the trade I first discussed on December 12th.

On the shortened trading day of Christmas Eve, January call options flew off the shelves in CONN. At the time of writing, the Jan $17.50s saw volume of 3,536 versus open interest of 2,395. The $19s saw volume of 6,452 versus open interest of 806. The $22.50s saw volume of 3,116 versus open interest of 841. I saw no other options come even close to this kind of volume. Open interest across all meaningful strikes is also much lower than these volumes. This is VERY bullish activity and not likely only the trades of someone hedging or selling calls against existing shares.

Source: Schaeffer’s Investment Research

The chart above shows that shorts are pressing their bets against CONN rather than taking advantage of the most recent collapse to cash in their chips. They clearly expect this company to experience a lot more hard times in 2015.

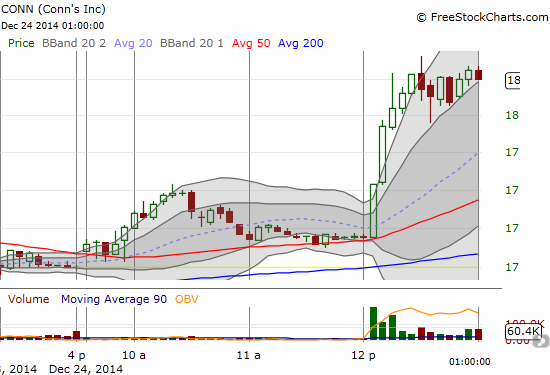

For now, technicals support the trade suggested by the options activity. Note that the trade is higher risk one than the trade I originally proposed given the stock has now moved about 29% off its latest low. Today’s move included a ramp in shares at lunchtime.

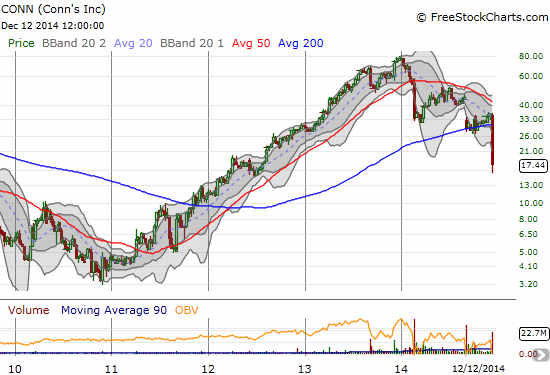

On December 12th, CONN printed a hammer, a common sign of a bottom where buyers rush in to take stock off its lows. Unfortunately, the very next trading day, CONN failed to confirm the hammer. The day after that failure, CONN invalidated the hammer by closing below its low. I took the stock off the radar at that point. The technicals now support a trade given the surge in buying volume since then, including the intraday surge shown above. The long up bar that completely reversed the last day of big losses served as the next bottoming signal. That signal has been confirmed by subsequent buying. Today’s close has even taken the stock above the close of the hammer.

Here is a reminder of the roller coaster ride that is CONN using the chart I posted last time.

Source for charts: FreeStockCharts.com

I would LOVE to say the stock represents tremendous upside potential, but such a declaration would be overly optimistic at this stage. One step at a time!

For this trade, I did not simply follow the options buyers. I thought through a few possibilities. I bought call options on Jan $20s, bought shares, and sold Jan $19s against the shares. The short calls partially pay for the 20s. The shares are in place in case this trade is actually one that extends beyond January expiration, especially if the stock does nothing but churn in the coming weeks. Recall that the February breakdown ushered in a slow three-month comeback before the stock succumbed again. The September breakdown ushered in a big spike that preceded a slower 2-month comeback before the next collapse. So, I am hoping this trade can last at least until the NEXT earnings announcement in late March. I will consider it a double bonus if the stock moves swiftly in the next three weeks as the call option activity seems to imply.

Be careful out there!

Full disclosure: long CONN shares and call options