(This is an excerpt from an article I originally published on Seeking Alpha on December 3, 2014. Click here to read the entire piece.)

Many are celebrating lower oil (USO) and gasoline prices (UGA) as a kind of tax cut for consumers. This tax cut will in turn boost consumer spending which itself leads to a boost for GDP growth. Since these claims in mainstream media often use anecdotes, intuitive thought exercises, and/or “man on the street” quotes as substitutes for hard evidence, I decided to dabble in the data and some research on the topic to get a sense of the reliability of these claims. It turns out the relationship between oil and gasoline prices and consumer spending is not simple or easy to tease out of the data. Indeed, while it seems “reasonable” to expect a positive economic impact from lower oil and gas prices, such a benefit does not appear guaranteed in the aggregate.

{snip}

Indeed, the research on this topic suggests that the response to lower prices can hinge on consumer expectations. {snip}

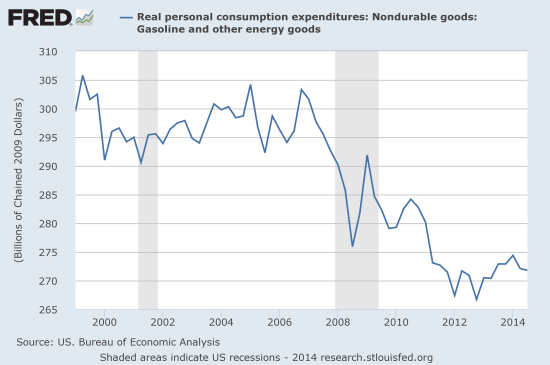

Source: St. Louis Federal Reserve

{snip}

Source: St. Louis Federal Reserve

{snip}

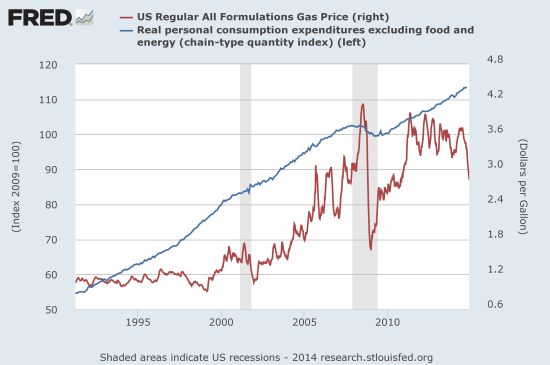

Source: St. Louis Federal Reserve

{snip}

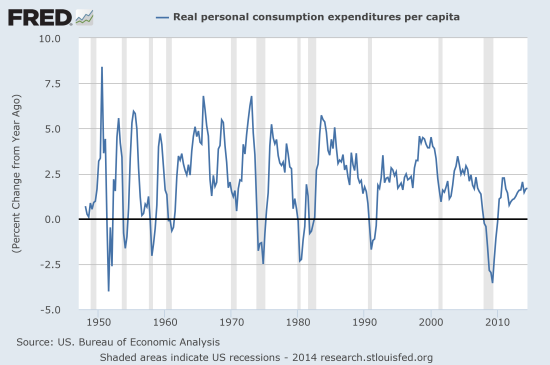

Source: St. Louis Federal Reserve

Source: St. Louis Federal Reserve

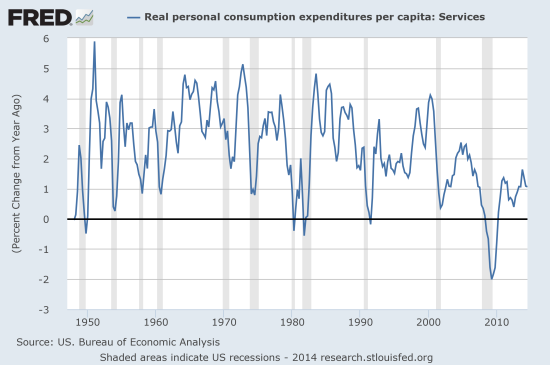

The growth slowdown in parallel with a general rise in oil and gasoline prices could of course be a pure coincidence. There are many other economic factors, exogenous and endogenous, that are likely suppressing growth in consumer spending over the past 14 to 15 years. So, I turned to some of the research for additional color. This is a field that of course has been well-studied by economists. And perhaps because it is so well-studied it is easy to find some disagreement.

Like so much in economics, conclusions can vary depending on the treatment of the data and the particular objectives of the analysis. From what I can tell, general agreement exists that an “unexpected” and “significant” increase in oil/gasoline prices has a directly negative impact on consumer spending in the short-term. Conclusions muddy up from there, especially when it comes to the impact of price declines. As an example, I read through and examined two interesting research papers, one from 2005 and one from 2009. {snip}

{snip}

In the end, I think the ultimate lesson is that we need to remain circumspect about the impact of changing energy prices on consumer spending and ultimately the economy. We are facing a very dynamic market with a LOT of influences. For example, what is VERY different about the current round of oil price shocks is the immense increase in production from the U.S. This is mostly a supply shock which has in turn created economic booms in concentrated locations in the U.S. Theoretically, there is a breaking point at which oil prices decline far enough to cause a significant decline in incomes in these areas which could negatively impact aggregate consumer spending. Texas has one of the healthiest and most robust housing markets in the country. It is not hard to conceive of a scenario where this market experiences a notable setback that ripples throughout the region with a suppressing impact on consumer spending.

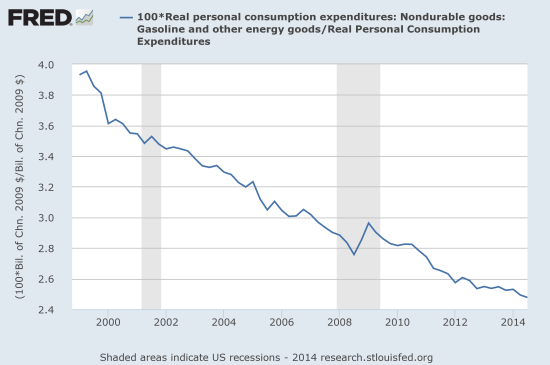

Perhaps most importantly, if consumers do not believe that low oil pries are here to stay for long, there is no reason to believe that current patterns in consumer spending will change much at all…at least not for long. Remember, consumers are now spending less than 3%, and falling, of their entire expenditures on energy anyway. It may be difficult to even see or feel the impact without a sophisticated regression model. Stay tuned on this unfolding story…

Be careful out there!

Full disclosure: no positions

(This is an excerpt from an article I originally published on Seeking Alpha on December 3, 2014. Click here to read the entire piece.)