$HLF catching my interest again as it rides into 50DMA resistance on heels of insider buying news. Shorts and put/call ratio at major highs

— Dr. Duru (@DrDuru) November 26, 2014

Here are the follow-up details on this tweet from Wednesday, November 26th, 2014.

Herbalife (HLF) has experienced a strong rally from recent lows. The stock has risen 9 out of the last 10 days on good trading volume. It is now resting just under resistance at the downward trending 50-day moving average (DMA).

Source: FreeStockCharts.com

Adding to the intrigue in the stock is the decision of the Chairman/CEO to hold all the stock he acquired from exercising expiring stock options granted to him 10 years ago. This is essentially free money for him so the statement is not as significant as it could be. Still, it should be duly noted as a potentially positive catalyst…or at least the CEO recognized the potentially NEGATIVE press he and the company would receive from converting all this stock into cold, hard cash. From the press release on Tuesday, November 25 titled “Herbalife Chairman and CEO Increases His Personal Share Holding in the Company“:

“Global nutrition company, Herbalife (NYSE: HLF), today announced that Michael Johnson, Herbalife’s chairman and CEO, has engaged in a net exercise transaction involving 750,000 stock options that were granted to him in December 2004 and were due to expire in December 2014. Because of his complete confidence in the continued and future success of the company, Mr. Johnson has decided that he will hold all the shares issued on exercise of the option, which will be the total amount, net of those necessary to cover the exercise price and any taxes related to the transaction.”

Making this PR play more interesting and more important is the building negative sentiment aligning against the stock: it has suffered two big post-earnings gap downs and a -46% year-to-date performance.

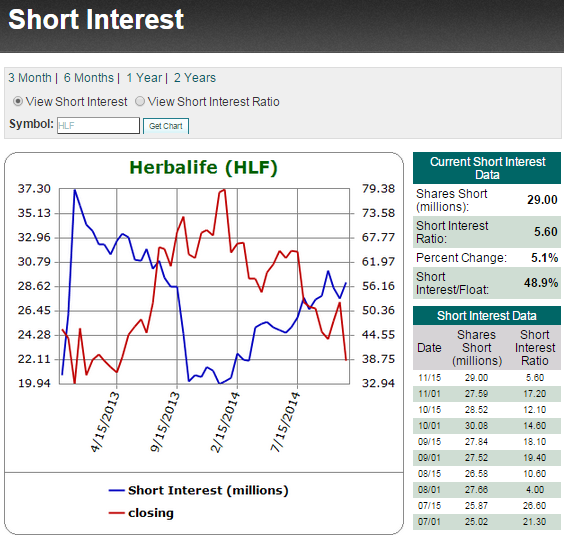

Shares short have risen all year against HLF as bears press their bets. Shares short have returned to levels last seen in September, 2013 and represent a whopping 49% of the float!

Source: Schaeffer’s Investment Research

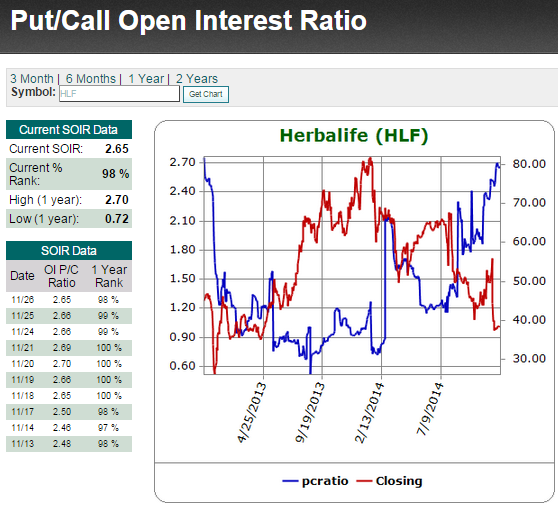

Options players have also been pressing their bets against HLF…

Source: Schaeffer’s Investment Research

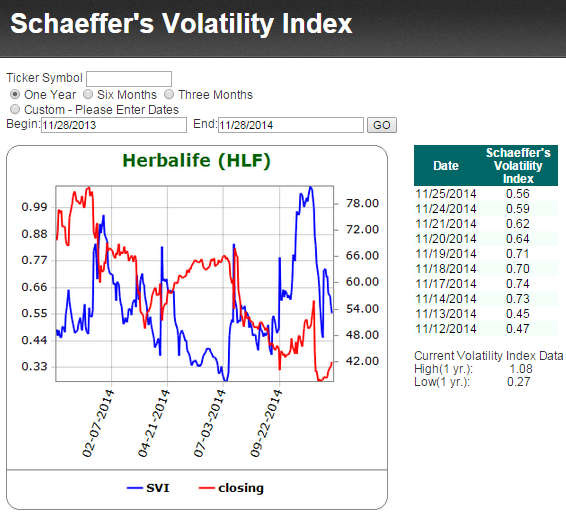

Despite the growing anticipation that HLF will continue to decline, collapse even, implied volatility is well off its highs. This means the market is not pricing in a big move in HLF in the near-term.

Source: Schaeffer’s Investment Research

A very simple trading strategy can be constructed from all this information. It can even be conditioned on whether you are inclined to bias bearish or bullish.

If you are bearish on HLF, this is a GREAT place to put in an aggressive short (if you can find the shares!) or better yet, buy options. The implied volatility suggests options are relatively “cheap,” and options automatically cap your potential loss…unlike a short. Bearish positions should stop out with a close above the 50DMA resistance that gets follow-through buying. More cautions and measured bears or otherwise agnostic traders can wait for HLF to confirm renewed weakness with a pullback from 50DMA resistance that provides a close BELOW Wednesday’s low of $42.

As bears are stopping out (or should be) above the 50DMA, bulls or otherwise agnostic traders can step in with buys assuming the stock should maintain its momentum off the lows. A good short-term upside target is the 200DMA resistance or a fill of the last post-earnings gap down.

However, HLF resolves the tensions at 50DMA resistance, I strongly suspect the move will be sustained given the massively negative sentiment on the stock. Either an unwind of this negative sentiment will provide a powerful upward catalyst or a sustained increase in negative sentiment will turn the stock southward all over again. The tame volatility numbers suggest that the move may not be dramatic, but it could very easily be sustained.

Be careful out there!

Full disclosure: no positions (yet!)