(This is an excerpt from an article I originally published on Seeking Alpha on November 4, 2014. Click here to read the entire piece.)

Tuesday morning in Australia was a busy time for economic news.

First, the Australian Bureau of Statistics reported that the release of the Apple (AAPL) iPhone 6 helped drive electrical and electronic goods retailing to a record 9.2% growth. {snip}

Source: Australian Bureau of Statistics

On the flip side, the Australian Bureau of Statistics reported that Australia’s balance of goods and services fell further in September…{snip}

Source: Australian Bureau of Statistics

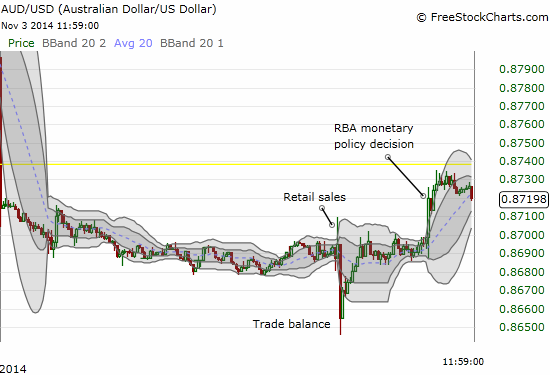

This whipsaw in good and then bad news was reflected in the intraday reaction of the Australian dollar (FXA). {snip}

Source: FreeStockCharts.com

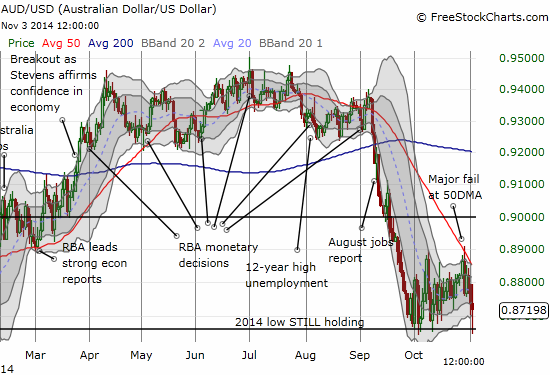

The RBA said nothing new in issuing its November policy statement. {snip}

With the market’s expectation for a rate cut in the next month increasing only slightly, I am expecting the Australian dollar to continue to hold its bottom for 2014 to close out the year, all else being equal. The ever strengthening U.S. dollar is of course a key wildcard. Relatively benign trading in the Australian dollar should also be supportive of other risk trades in financial markets.

Source: The Australian stock exchanges’s RBA Rate Indicator – December 2014

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November 4, 2014. Click here to read the entire piece.)

Full disclosure: net long the Australian dollar