(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 50.3%

VIX Status: 12.3%

General (Short-term) Trading Call: Can add to existing buys now that the S&P 500 has broken out above its 50DMA. Stop on a close below the 50DMA. Cannot consider shorting until such a breakdown or T1208 overbought conditions.

Active T2108 periods: Day #289 over 20% (includes day #280 at 20.01%), Day #3 over 40%, Day #1 over 50% (overperiod), Day #28 under 60%, Day #29 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

Commentary

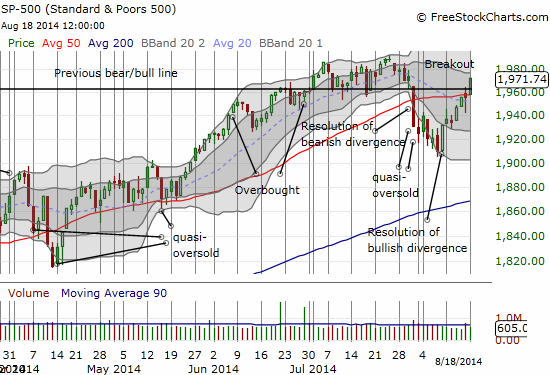

Monday’s surge for the S&P 500 (SPY) above its 50-day moving average (DMA) provided great validation of my rule to avoid trading on headlines. The 0.85% gain also took the index above the previous bear/bull line. With oversold conditions fading in the mirror and likely leaving behind overly aggressive bears who yet again failed to chase the market down, today’s move on the S&P 500 is fully bullish.

Of course, only new highs (all-time and 52-week) will validate this bullish push. As I assess the odds I just remind myself what has happened after each bounce back from sell-offs inspired by negative headlines…

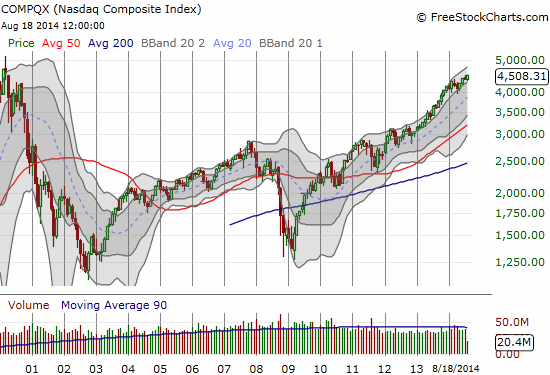

Incredibly, the NASDAQ (QQQ) punched to fresh FOURTEEN-year highs. I think this is a great occasion for showing a monthly chart…

I am truly embarrassed to have to look back on this chart with hindsight to report that buying a simple breakout above the highs of the last bull market could have been just one of two trades over the last three years. The other trade would have been either to buy the subsequent dip in 2011 for truly committed bulls or to buy again on the next breakout in 2012. This is classic “trend is your friend” kind of action. Heck, it is even “buy the dip” kind of action.

In the wake of the dot-com crash in 2000, two friends and I placed bets on the number of years the NASDAQ would need to establish a full recovery. I was the most bearish at 25 years. My friends bet 10 and 15 years. At least that bet was made in 2001 dollars…

T2108 closed at 50.3%, climbing another five percentage points. It continues to confirm the bullish bounce from oversold conditions earlier this month.

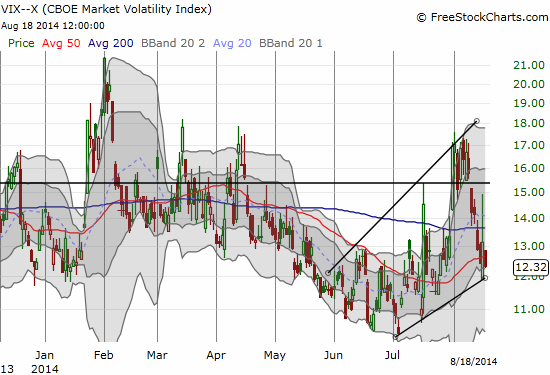

The volatility index, the VIX, has of course continued to plunge. Last week’s surge toward the 15.35 pivot is almost ancient history as the VIX now tests the lower edge of the presumed upward channel.

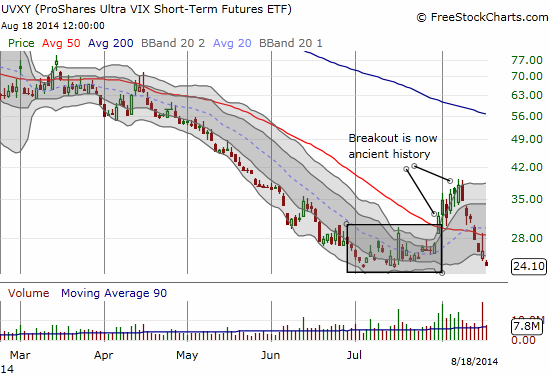

ProShares Ultra VIX Short-Term Futures (UVXY) is of course getting freshly crushed and ground. Its breakout above the 50DMA is definitely ancient history now.

Now for some interesting stock charts fitting for the current trading setup…

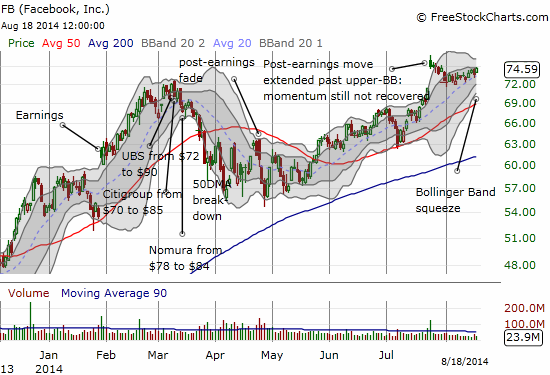

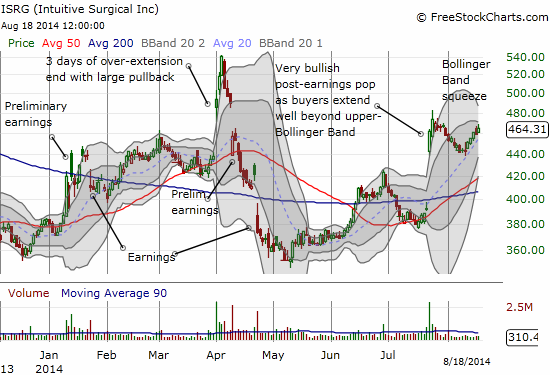

Facebook (FB) and Intuitive Surgical (ISRG) are experiencing Bollinger Band (BB) squeezes. In both cases, post-earnings moves took the stocks well above their respective upper-Bollinger Bands and essentially exhausted buyers. Both stocks are struggling to regain post-earnings momentum. A breakout (or breakdown) from here should be quite decisive. In particular, if FB manages to breakout higher, it could/should be part of a fresh rally in tech and the stock market in general: I cannot imagine a major sell-off in the middle of a fresh FB run-up.

Another sign buyers are on the move…U.S. Steel (X) continues its strong post-earnings rally as it punches a fresh 3-year high. I am guessing buyers are hunting out relatively “cheap” stocks that can help them play catch up with the stock market. At the beginning of this year, I said I would pay more attention to steel stocks again and start writing about them. I never got around to it, and I certainly regret it now! (AKS Steel (AKS) is still in my portfolio). I can only watch now. A person on twitter reminded me about Nucor (NUE). The stock is around post-recession highs but is essentially flat on the year. Perhaps there is still good catch-up potential there…

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long UVXY shares and puts, long SSO call options, short FB and long call options, long ISRG call options