(This is an excerpt from an article I originally published on Seeking Alpha on July 5, 2014. Click here to read the entire piece.)

As I have warned on several occasions, the adage to “sell in May” and go away until the Fall is an over-simplified approach to trading around the summer months. It turns out that the adage is mainly based on the severity of summer downturns when they DO occur and NOT on the frequency of summer sell-offs. In fact, summers overall tend to deliver good opportunities to buy dips and to participate in tradeable rallies.

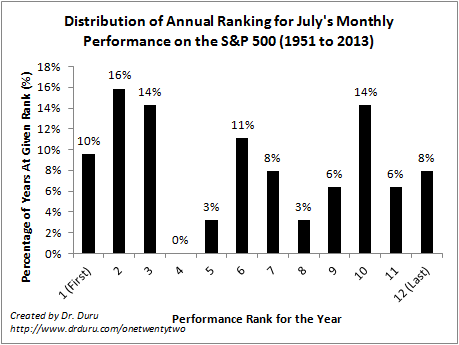

For the second year in a row, the S&P 500 (SPY) gained around 2% in May. This May’s breakout to fresh all-time highs has continued into the summer. The second half of the year has started well with a 1.3% month-to-date gain in the first three days of July. If history is any guide, July will be the marquee month of the summer. It could even be top-ranked for the year.

{snip}

{snip}

{snip}

Source for all price data: Yahoo Finance

A hit tip goes to Nightly Business Report which motivated me to examine July’s performance on a comprehensive basis. Portfolio repositioning was the most plausible explanation offered for July’s stand-out performance. Such an explanation is particularly consistent with the unusually strong starts for trading in July. The idea is that big funds make major portfolio adjustments for the second half of the year in July. These moves would of course need to result in net overall buying; apparently they do.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 5, 2014. Click here to read the entire piece.)

Full disclosure: no positions