(This is an excerpt from an article I originally published on Seeking Alpha on June 15, 2014. Click here to read the entire piece.)

It appears the National Association of Home Builders(NAHB)/Wells Fargo Housing Market Index (HMI) has indeed stabilized.

Last month, I interpreted a small recovery in the HMI from a March plunge as a sign of stabilization. The jump in the June HMI seems to have confirmed that interpretation.

Source: National Association of Home Builders (NAHB)

{snip}

Regardless, the good news is that downward momentum has not taken hold. {snip}

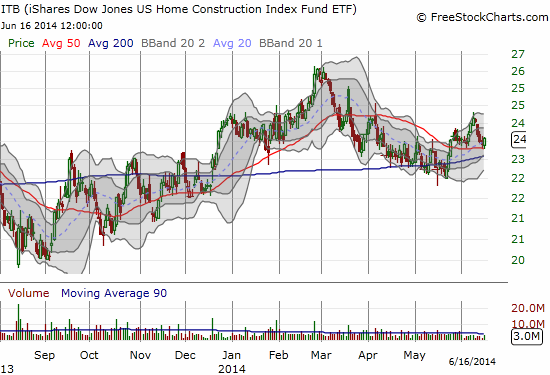

Source: FreeStockCharts.com

Note well that the NAHB commentary accompanying the latest HMI reading reflected continued caution. The aggregated HMI is at 49 so it is just short of indicating “good building conditions”:

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 15, 2014. Click here to read the entire piece.)

Full disclosure: long ITB call options