(This is an excerpt from an article I originally published on Seeking Alpha on June 14, 2014. Click here to read the entire piece.)

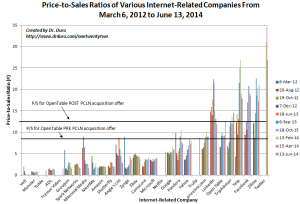

So now we know that at 8 or 9x times 12-months trailing revenue, an internet-related stock can be undervalued.

On June 13, 2014 Priceline (PCLN) offered to buy OpenTable (OPEN) for $2.6 billion, about a billion more than the company was worth (in market cap) at the time of the offer. This deal provides one more sign that the huge sell-off in high multiple stocks earlier this year likely found a bottom for a while in May.

This deal also offers a fresh compass for valuing internet-related stocks in terms of “willingness to pay.” {snip}

Click imagine to see a larger view…

Source: Data from Yahoo Finance

{snip}

It is hard to say whether Priceline overpaid for OpenTable or whether it even matters relative to Priceline’s $62B market cap size. Priceline has $6.7B in cash and short-term investments as of March 31, 2014. This is little changed from the previous quarter, but represents a 29% year-over-year increase. So, PCLN has money burning a hole in its pockets, and the OPEN deal is just a little more than a drop in the bucket relative to its ability to generate cash. On the conference call explaining the deal, Priceline noted that it felt comfortable paying cash given its strong balance sheet and ability to access funding from capital markets.

The valuation question is also complicated by what PCLN sees as OpenTable’s potential in a synergistic world. The company gave several reasons for the deal, including strategic considerations:

{snip}

Interestingly, Priceline clarified twice that the company is not suddenly becoming acquisitive. Its focus remains on organic growth. Priceline also does not see the need to vertically integrate in any particular demand channel. This claim will cool any talk of additional acquisitions by Priceline, but it of course did not stop speculation on what internet/mobile-related companies could be next on the auction block.

Yelp (YELP) benefited the most from speculative trades on the potential for future deals. YELP increased 13.8% in value on the day. Its price-to-sales ratio was already high; with a 18.0 ratio it remains well above OPEN’s valuation. I bought a single speculative put option on YELP just in the off-chance that this kind of comparison might settle YELP down over time. YELP aside, the above chart shows that there could be a LOT of upside room for many smaller companies if bigger ones come a-knocking with eyes for synergies and unrealized scale. Value is in the eye of the beholder. Stay tuned…

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 14, 2014. Click here to read the entire piece.)

Full disclosure: short FB, long AMZN, long YELP put, long ZNGA, long Pandora puts, long LinkedIn, short Twitter put spread