(This is an excerpt from an article I originally published on Seeking Alpha on March 9, 2014. Click here to read the entire piece.)

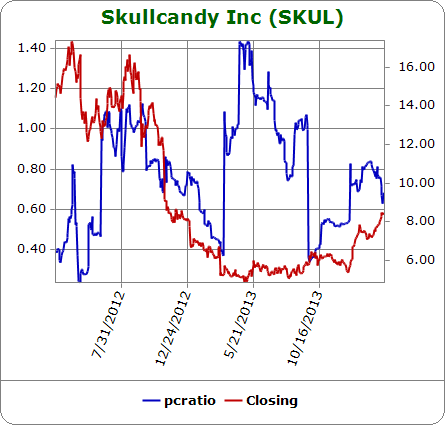

Way back on December 24, 2012, I wrote “Reasons To Bet On A 2013 Recovery For Skullcandy.” In less than two weeks, I had to write a near apologetic follow-up after a downgrade from Jeffries took the stock down another 13% in one day. It took another four months for the stock to finally bottom, including a retest three months later. Fortunately, I stuck with the thesis and continued scaling into my position. On Friday, March 7th the big payoff finally arrived in a big post-earnings surge higher. The recovery for Skullcandy (SKUL) has finally arrived…but it comes with a major caveat from a stock that went berserk in response.

First, let’s check off on the reasons I cited for remaining optimistic: a rapid reduction in short interest and the potential stated in the Q3 2012 earnings report.

{snip}

Source: Schaeffer’s Investment Research

{snip}

Source: Schaeffer’s Investment Research

{snip}

First, 2013 was a year when the top leadership in SKUL turned over. {snip}

{snip}

Perhaps most important for SKUL in this turn-around story is its healthy balance sheet. {snip}

There were also some key quotes from the earnings conference call. {snip}

Source: FreeStockChart.com

{snip} In the coming weeks, I will also be watching to see whether SKUL’s ascendance has recharged the interest of short-sellers…

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on March 9, 2014. Click here to read the entire piece.)

Full disclosure: no positions