When Nomura upgraded Twitter (TWTR) on May 28th to a “buy” with a $43 price target, the subsequent bounce that sent the stock up 10.7% on the day had all the appearances of a convincing bottom. The stock had previously drifted lower for two weeks to create a “soft” retest of all-time lows. Earlier analyst upgrades had failed to keep the stock aloft; thus there was every reason to start fearing a fresh rush for the exits. However, the Nomura-inspired bounce happened off the first Bollinger Band (BB) and brought two days of high volume buying, seemingly confirming the change in sentiment and assessment of the relative value of the stock at these levels.

The Nomura upgrade continued a string of sentiment shifts that I highlighted in “Hints of Bottoming for Twitter.” Unfortunately, the one-day of follow-through buying turned into a subsequent reversal. That selling created an ominous abandoned baby top formation. The buyers at the top find themselves in the unfortunate position of having chased the stock higher only to experience instant losses the next day on a gap down. It creates the potential of overhead resistance as these eager buyers turn into instant sellers if price rises again to provide relief. The chart below shows that the upgrade cycle has yet to break the downtrend firmly in place on TWTR since the beginning of the year.

Source: FreeStockCharts.com

I am watching the abandoned baby top closely as the pattern served as a confirming top following the crescendo that ended TWTR’s insane late 2013 rally. These topping patterns are most powerful after a strong rally. I am also watching the 20 and 50-day moving averages (DMAs). Until TWTR can break them and sustain price levels above them, the downtrend is the presumed path of least resistance.

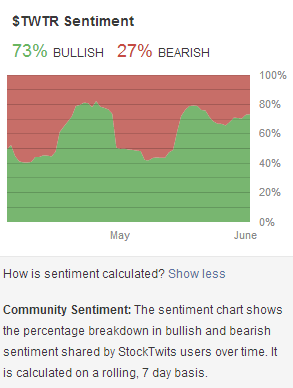

The Nomura upgrade hinged on the overwhelmingly negative sentiment clouding TWTR. The analyst claimed that the market has now priced in TWTR as a “niche social media product”, creating a much better risk/reward proposition. Moreover, the upgrade stretches for margins higher than consensus and an earnings growth model extending to 2017 to get a 24x P/E. In other words, the upgrade is not just a presumption that the stock has sold off to account for negative sentiment, but it is also an aggressive bet on the future. I think this kind of optimism is premature. The near 50% reversal of the Nomura-inspired gains may indicate agreement with my thinking.

Regardless, I am sticking with my “hints of a bottom” even as the possibility of a break of all-time lows to form one more washout of eager sellers is back on the radar thanks to the abandoned baby top (the buyers trapped at the top of the pattern are not likely to tolerate the pain of fresh lows). This same pattern has capped my near-term upside expectations. Net-net, I am now looking at an extended period of churn for TWTR. That churn will be healthy it forms a solid base for the stock where accumulation happens slowly but surely, drying up motivated sellers.

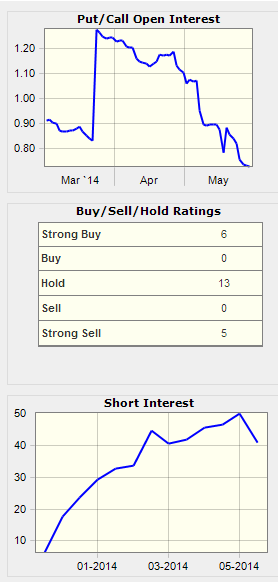

The data from Schaeffer’s Investment Research show that options players continue to rush on a relative basis to bet on upside. Shorts have finally pulled back to the tune of about 20% of shares. While it is certainly possible the relative dominance of call options represents increased hedging, I think on balance these changes are bullish at the lows for a stock. Moreover, overall analyst opinion remains firmly negative. This provides yet more headroom for analyst upgrades that help to keep sentiment turning upward. My opinion might change when/if TWTR finally gets a downgrade or firm reiteration as a sell.

Source: Schaeffer’s Investment Research

Note that short interest is 10.4% of float as of May 15th.

As far as trades, my first bet on a bottom closed out on Friday with a covered call position that expired. That trade worked well, but in retrospect I wish I had not shackled myself with the short call option. Now I have bullish positions in a short put option (which I was VERY tempted to close out last week!) and short a put spread. I got decent premiums as implied volatility temporarily spiked on the post-lockup selling. The put positions are both monthlies expiring in June and July respectively. If TWTR manages to break through the abandoned baby top pattern, I will get a LOT more aggressive on the bullish side. If TWTR descends into a fresh wave of selling, I will re-evaluate my strategy at that time. I remain committed to the current positions even if they result in (discounted) positions in TWTR shares.

Source: StockTwits.com

Be careful out there!

Full disclosure: short a put and put spread on TWTR