(This is an excerpt from an article I originally published on Seeking Alpha on May 5, 2014. Click here to read the entire piece.)

The latest U.S. non-farm employment report showed another strong print for employment in residential construction. For the 31st month in a row, seasonally adjusted employment in residential construction showed year-over-year growth. The 659,300 workers are the highest since March, 2009. Year-over-year growth was a strong 8.2% and month-over-month growth was 6.9%. The slowdown in the growth rate I continue to anticipate clearly remains further out on the horizon than I thought.

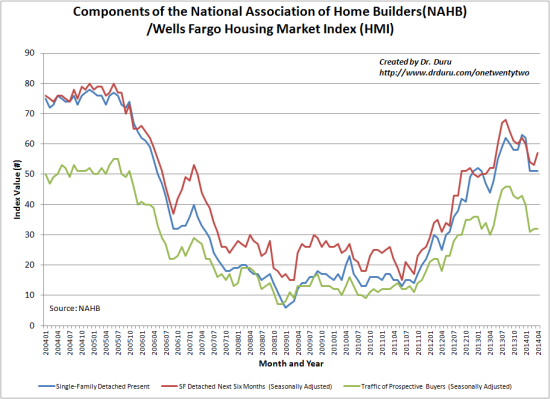

This pace of employment growth continues despite the end of the upward momentum in home builder sentiment. {snip}

Source: National Association of Home Builders (NAHB)

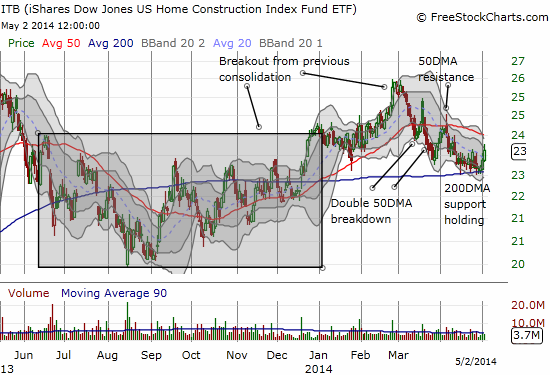

The trading action in the iShares US Home Construction (ITB) adds to a sense of stabilization. When the breakout in ITB ended in March, I braced for extended rangebound trading with a correction close to the lows from 2013. {snip}

Source: FreeStockCharts.com

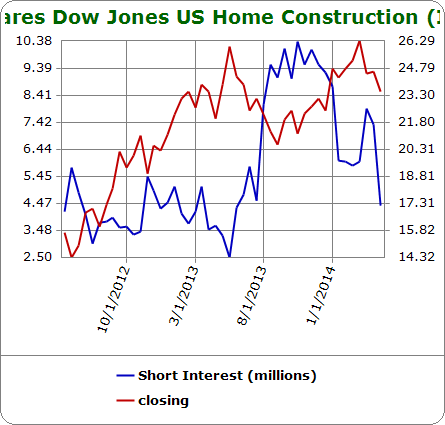

Moreover, short interest in ITB continues to decline. {snip}

Source: Schaeffer’s Investment Research

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 5, 2014. Click here to read the entire piece.)

Full disclosure: long TPH and call options on ITB and TOL