(This is an excerpt from an article I originally published on Seeking Alpha on February 25, 2014. Click here to read the entire piece.)

RealPage (RP) provides software for revenue management and other related services for managers of rental housing. After noticing that the stock had dropped over 20% in after hours trading following the release of the latest earnings numbers, I decided to listen in on the earnings conference call. I wanted to understand whether RP’s troubles had anything to do with changing economic conditions in the rental market or whether they could be extrapolated out to housing in general. The final word on that is still uncertain, but I found the report interesting anyway.

A shortfall in “organic” on-demand revenue growth is RP’s main headline from fourth quarter earnings. Not only did the year-over-year growth of 12% miss the company’s target of 20-25% by a wide margin, but also RP warned on financial performance for the year. The fourth quarter miss ended thirteen straight quarters of 20%+ year-over-year growth since RP’s IPO. RP noted that three of the main negative factors impacting the business are likely to turn-around by this year’s fourth quarter.

{snip}

{snip}

I was most interested in RP’s description of how a slowdown in leasing velocity impacted its business; leasing velocity accounts for about 18-19% of RP’s on-demand revenue (not clear whether this is organic or all-inclusive). RP was not clear on how or when this negative impact will turn around. According to RP, rental managers emphasized renewals over resident churn in the fourth quarter despite “record levels of occupancy…driven by extraordinary levels of demand and inadequate supply, especially in the middle market assets as the majority of new construction is high-priced Class-A properties.” Under these conditions, RP expected rental managers to prefer to sign new renters at higher lease rates. {snip}

Needless to say, I will be watching RP much more closely in coming quarters to see how this issue of leasing velocity unfolds. I will be particularly keen to understand any broader economic implications.

{snip}

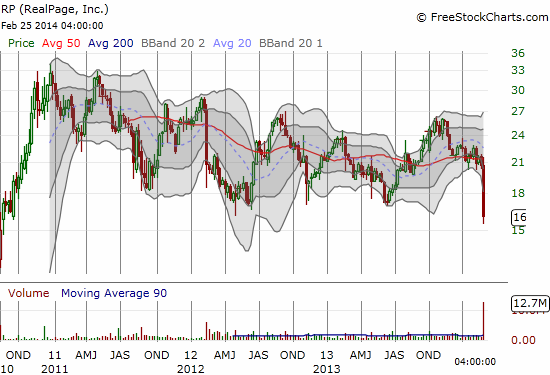

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 25, 2014. Click here to read the entire piece.)

Full disclosure: long RP