(This is an excerpt from an article I originally published on Seeking Alpha on February 25, 2014. Click here to read the entire piece.)

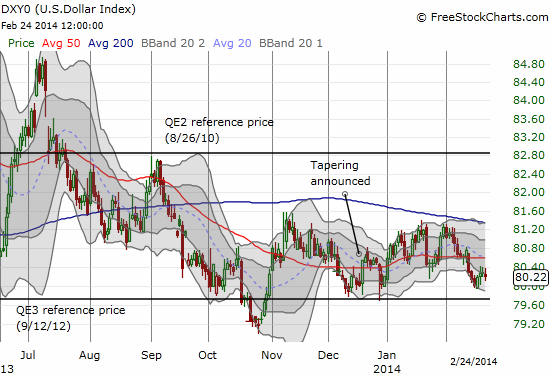

So far, 2014 has included more angst about emerging markets, a large (and temporary) spike on volatility, a sharp rally in bond prices, and an impressive (counter-trend) rally in gold. Through all the excitement, the dollar index (UUP) has just plodded along. In fact, it closed today exactly where it ended 2013.

In an aptly titled segment called “What’s stopping the dollar?”, Hard Currency (form the Financial Times) explored why the dollar has defied 2014 analyst expectations for a rally. Matt Cobon, head of rates and currencies at Threadneedle Investments, explained that the economic data have been so far a bit softer than expected. However, the U.S. dollar is also not selling off on these data because expectations remain set at above trend growth. {snip}

Source for charts: FreeStockCharts.com

The tightening trading range on the U.S. dollar defies attempts to do anything beyond the broadest set of correlations to other financial instruments. {snip}

{snip}

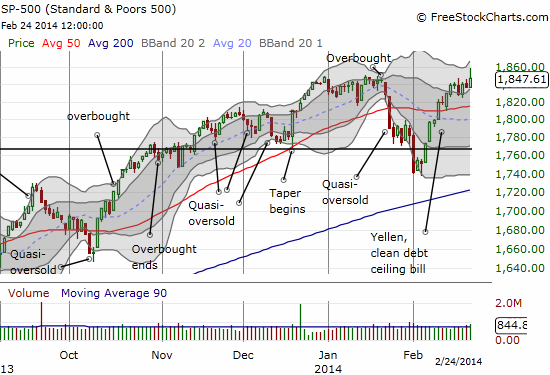

In other words, it may be that, for now, correlation matters much less than non-confirmation.

As the market scrapes at the same overbought levels that proved to be a ceiling on January 23rd, I find myself once again watching the dollar index for subtle clues. I will take sharp notice if the dollar index somehow manages to break the lower part of its trading range on, for example, poor economic data: such a move would mark a dramatic change in existing trading patterns. Stay tuned… {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 25, 2014. Click here to read the entire piece.)

Full disclosure: net long U.S. dollar index, long GLD, long SSO puts, long AUD/JPY