(This is an excerpt from an article I originally published on Seeking Alpha on February 3, 2014. Click here to read the entire piece.)

On January 22, 2014, the Bank of Canada left its target overnight interest rate at 1%. However, the Canadian dollar (FXC) slid quickly against the U.S. dollar anyway as the currency continues a run toward my 1.16 target (on USD/CAD) at a clip much faster than I expected. After losing about 6.5% against the U.S. dollar last year, the Canadian dollar has already lost another 4.6% in the month of January.

Source: FreeStockCharts.com

I read through the detailed Monetary Policy Report accompanying the press release and watched the press conference for confirmation of an increasing dovishness in tone from the Bank of Canada. The Monetary Policy Report tells enough of the story, so the rest of this review focuses there.

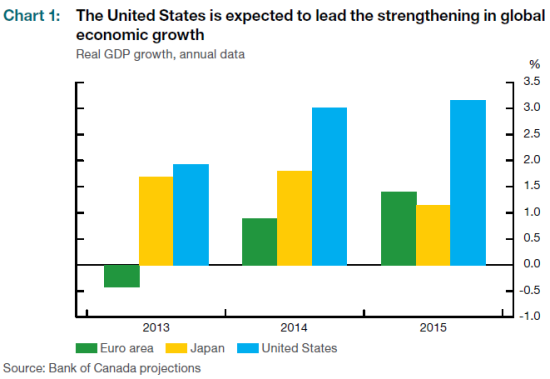

The most striking part of the report is the outright bullishness on the U.S. economy, the optimism for the global economy, and the very measured commentary on the Canadian economy. One of the Bank’s key observations: “Global economic growth is expected to strengthen over the next two years, led by stronger momentum in the United States.”

Source: Bank of Canada, Monetary Policy Report, January 2014

I believe the Bank of Canada’s assessment is a consensus one. It helps me understand why financial markets rumble these days anytime growth in the U.S. is called into question.

{snip}

The Bank of Canada’s explanation for the U.S. economic expansion highlights the Bank’s bullishness on the U.S.:

{snip}

(As an important side note to the Bank’s bullishness on U.S. housing, the report includes a forecast for higher lumber prices “…supported by the ongoing recovery in the U.S. housing sector. I consider these forecasts to be additional validation for my bullish expectations for U.S. housing in 2014).

The Bank’s ruminations on potential upside surprises for the U.S. economy are even more telling:

{snip}

Contrast this “warning” with the risk the Bank of Canada sees for the Canadian economy: “there is a risk that the recovery in non-commodity exports may take even longer than anticipated, given ongoing competitiveness challenges and potential supply constraints.”

Moreover, the Bank of Canada sees a continued risk in a “disorderly unwinding” in Canada’s housing market:

{snip}

During the Q&A portion of the press conference, Governor Stephen S. Poloz pronounced multiple times that the balance of risks for Canada are more tilted to the downside. Poloz would not commit to a dovish or hawkish bias; instead, he is firmly neutral.

The separation in expected growth rates between the U.S. and Canada could by itself explain much of the market’s repricing of the USD/CAD currency pair. Indeed, the Bank cites improving growth prospects in the U.S. (along with reduced safe-haven buying) as a reason for the depreciation of the Canadian dollar. But there is more.

{snip}

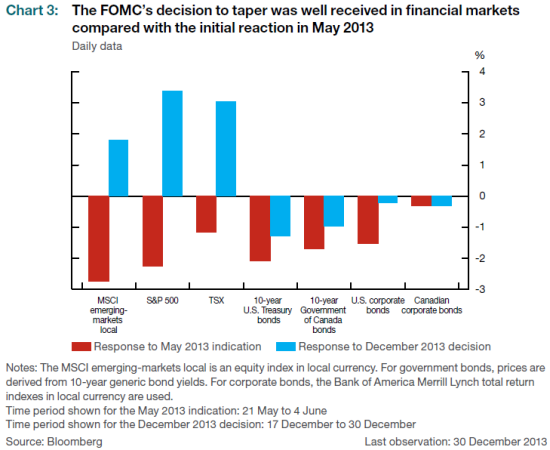

Source: Bank of Canada, Monetary Policy Report, January 2014

Most telling are the comments about the currency indicating that the exceptionally strong Canadian dollar was hurting Canada’s economic performance and that further depreciation promises several benefits (this is one of the main points I argued last April which set-up my long-standing bearishness on the Canadian dollar)…

{snip}

The strong Canadian dollar has been largely responsible for the lack of rebalancing, and it remains a problem:

“…the Canadian dollar remains strong and will continue to pose competitiveness challenges for Canada’s non-commodity exports.”

{snip}

Be careful out there!

Source: Bank of Canada Monetary Policy Report, January 2014

Full disclosure: long USD/CAD

(This is an excerpt from an article I originally published on Seeking Alpha on February 3, 2014. Click here to read the entire piece.)