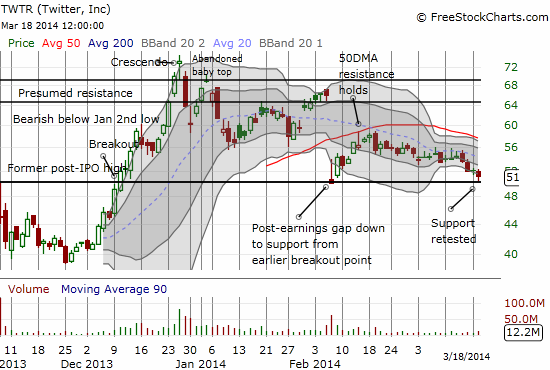

It took a while, but Twitter (TWTR) finally retested suport just over $50. It was something I wrote about shortly after TWTR rebounded sharply from its post-earnings gap down.

Note the pinpoint accuracy of the retest that you just cannot make up. Whether TWTR ultimately survives this retest is probably largely dependent on the sentiment in the overall market.

Verisign (VRSN) plunged again. This time it was news on March 17, 2014 of the National Telecommunications and Information Administration’s (NTIA) announcing its intent to transition key Internet domain name functions. VRSN dropped immediately in response and the fire alarm bells were clearly ringing loudly back at headquarters. VRSN published a news release reassuring the panicking throngs that the NTIA’s news has no impact on VRSN’s revenue-generating business.

“The announcement by NTIA on Friday, March 14, 2014, does not affect Verisign’s operation of the .com and .net registries. The announcement does not impact Verisign’s .com or .net domain name business nor impact its .com or .net revenue or those agreements, which have presumptive rights of renewal.

The NTIA announcement involves Internet functions that are entirely different functions from those Verisign performs under its .com and .net agreements. The functions performed by Verisign involved in the NTIA announcement have been performed as a community service spanning three decades without compensation at the request of the Department of Commerce under the Cooperative Agreement.”

As soon as I saw the headlines for the news release I rushed to fade the selling. I was a little late, but I managed to sell a put option with a good risk premium. If I was even more nimble I would have loaded up on shares as well. A day later, VRSN has already tested presumed resistance at the 200-day moving average (DMA). The chart shows two classic examples of selling over-extending its welcome well below the lower-Bollinger Band (BB).

Source for charts: FreeStockCharts.com

Be careful out there!

Full disclosure: long TWTR puts options and long-term call spread; short VRSN put