(This is an excerpt from an article I originally published on Seeking Alpha on January 14, 2014. Click here to read the entire piece.)

Right on the heels of proposing to acquire Riverbed Technologies (RVBD) for $19/share, Elliott Management made fresh waves with a plan to restructure Juniper Networks (JNPR). Elliott calculates that its proposal could send JNPR to $35-40/share. Accordingly, JNPR soared 7.6% in reaction even as it has already marched in a near straight line in a strong recovery from October’s poor earnings showing.

Source: FreeStockCharts.com

Elliott’s proposal is 28 pages long, but it is an easy read. In this post, I highlight what I found most interesting and end with an update on the JNPR versus Cisco Systems pairs trade I proposed on November 17th of last year.

{snip}

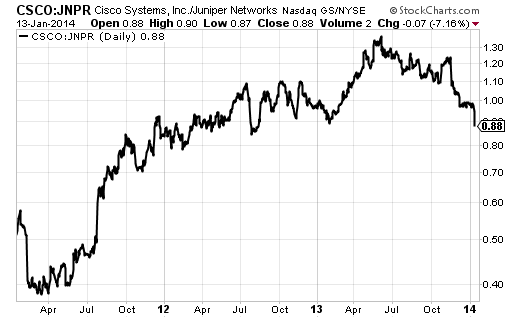

I never did get to implement the pairs trade. I already owned the JNPR calls at the time and sold those into the on-going run-up. CSCO never rallied before that to provide a better entry point for the put options (in fact, the stock sold-off further in that time, much to my surprise). NOW, I think the CSCO/JNPR ratio is no longer a bargain. JNPR’s run-up has brought the ratio back to levels last seen in mid-2012.

Source: StockCharts.com

With the current momentum, I do not think there will be another good opportunity for a pairs trade for a long while. Now, I am much more focused on the opportunity at JNPR.

JNPR’s run-up has not yet convinced the skeptics. According to Schaeffer’s Investment Research, analysts remain staunchly bearish with 7 of 23 rating JNPR a strong buy, 15 at neutral, and 1 at a strong sell. Moreover, bets against JNPR have rapidly increased during the run-up. The open interest put/call ratio made a bottom in early December and has risen steadily since – from about 0.38 to as high as 0.65 a few days ago. The ratio has dipped a little, likely in response to traders rushing to make bullish bets on JNPR after Elliottt’s offer to buy RVBD.

Shares short are also on the rise. While just 4.7% of the float as of December 31, 2013, shares short have more than doubled since the end of October. Shares short have gone from 9.2M shares to 19.8M shares in less than three months. The run-up in negative sentiment will soon collide with earnings on January 30th. I expect more fireworks as a result.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 14, 2014. Click here to read the entire piece.)

Full disclosure: no position