(This is an excerpt from an article I originally published on Seeking Alpha on July 30, 2013. Click here to read the entire piece.)

Depressed asset markets often include inherent supply/demand ironies. When prices drop to depressed levels, buyers should show up in droves to take advantage of the bargains. Of course, a market gets depressed specifically because so many lack the economic wherewithal to buy and too many are confronted with the stark reality of the urgent need to sell. So, instead of taking advantage of low interest rates, low prices, and high affordability, some (many?) buyers are waiting and waiting until the economic landscape looks “safe.” Of course, the era of safety is exactly when prices have already normalized, bargains are harder to find, and rates are much higher. In today’s housing market, opportunistic investors are the bargain hunters who are slowly but surely driving prices upward toward.

And so its seems that the fate awaiting young people abstaining from the housing market is to buy a home only after prices have already substantially increased. These young people are apparently waiting out the housing recovery under the shelter of parents and/or extended time with multiple roomates. {snip}

At some point, these young people WILL move out. Whether it is marriage, convenience, or the old-fashioned desire for independence, young people will face the reality that maturity is likely best pursued elsewhere. Even if they start off renting, an improved economy will finally motivate them to invest in, rather than just consume, housing. The longer this process takes, the greater the pressure created through pent-up demand. Moreover, new cohorts of young people will crowd into the market. The inevitable competition for housing should spur all sorts of housing activity.

This potential dynamic is an important consideration that I did not include in my two-part series questioning claims that Baby Boomers will ignite a “Senior Sell-Off” around 2020 (click here for Part 1 and Part 2). {snip}

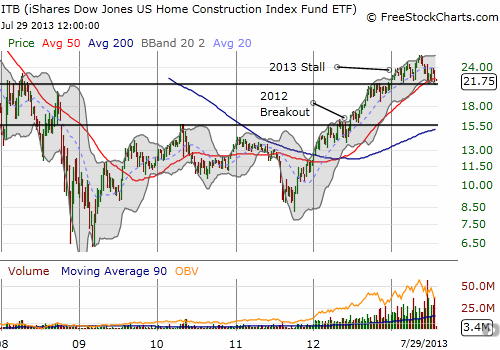

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 30, 2013. Click here to read the entire piece.)

Full disclosure: no position