(This is an excerpt from an article I originally published on Seeking Alpha on January 13, 2014. Click here to read the entire piece.)

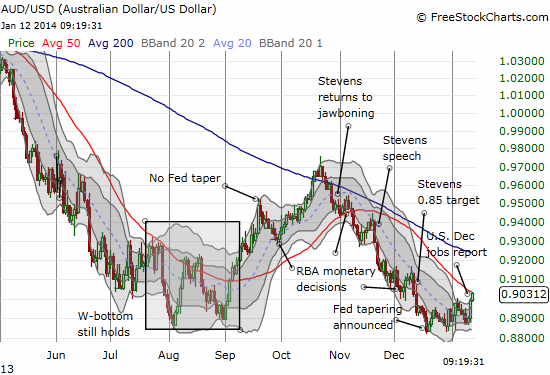

I started this year with a bullish bias on the Australian dollar (FXA) with a short-term target set at the 50-day moving average (DMA) (see Australian Dollar Starts The Year With A Bias For Bottoming). The target was not far away, yet the Australian dollar drifted downward for over a week before regaining momentum. That momentum has come in the wake of a U.S. jobs report that disappointed traders and sent interest rates dropping to around a one-month low.

Source: Bloomberg

{snip} …the Australian dollar has hit the target at a lower point than I originally expected.

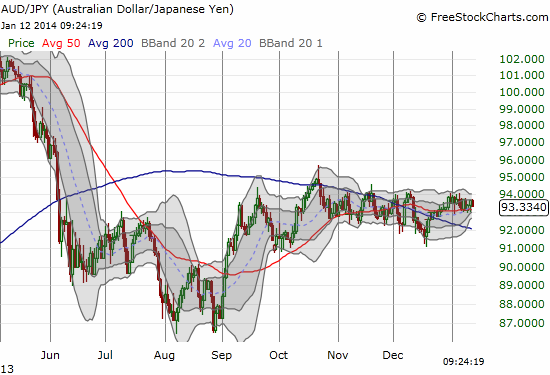

Note well that the Australian dollar’s strength is not just against the U.S. dollar. It has recently gained momentum against the euro (EUR/AUD) and the pound (GBP/AUD). In keeping with the theme of “joined at the hip” with the Japanese yen, the spike in the Australian dollar as Asian trading opened was matched almost perfectly with a show of strength from the Japanese yen. The end result continues to be a very flat AUD/JPY currency pair.

Source: FreeStockCharts.com

{snip}

However, now that the Australian dollar has hit the target, I have significantly scaled back the bullish bias to neutral. Australia is next up to report employment numbers on Wednesday evening. If the unemployment rate deviates significantly from the previous reading of 5.8%, I do expect the Australian dollar to respond sharply and swiftly. Traders will interpret a large change as indicative of the likely bias and/or action for the Reserve Bank of Australia in its next statement on monetary policy (early February). I prefer to wait, watch, and react before establishing the next trading bias.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 13, 2014. Click here to read the entire piece.)

Full disclosure: net neutral Australian dollar