(This is an excerpt from an article I originally published on Seeking Alpha on January 12, 2014. Click here to read the entire piece.)

It looks like the Bank of Canada was indeed setting the groundwork for easing monetary policy when it sounded fresh alarms about the Canadian economy last year. The extremely weak employment report for December seems almost certain to motivate the Bank of Canada to at least express an outright dovish tone if not drive an outright rate cut.

The numbers for December were discouraging on a month-over-month and year-over-year basis. {snip}

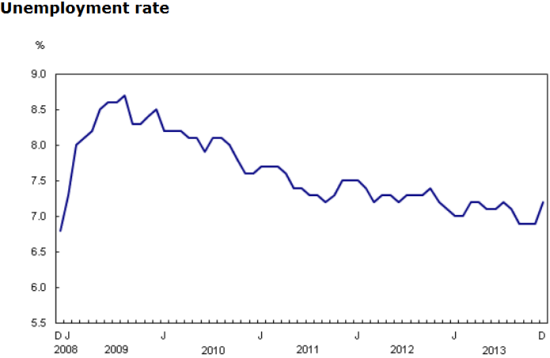

According to Statistics Canada, “Employment growth averaged 8,500 per month in 2013, compared with 25,900 in 2012.” This represents a sharp decline in job growth that will be difficult for the Bank of Canada to ignore, especially with inflation still well below target. There should also be growing alarm about the unemployment rate which has now shown little to no improvement in two years.

Source: Statistics Canada

{snip}

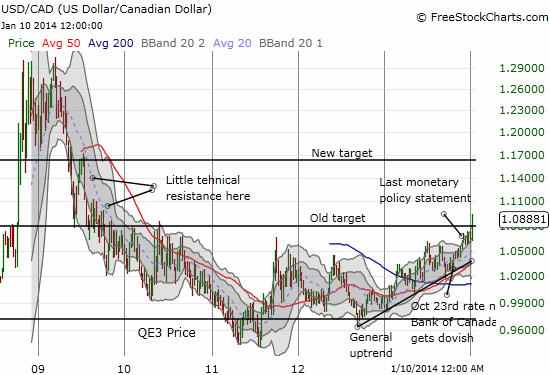

The response in the Canadian dollar versus the U.S. dollar (FXC) was immediate even as the U.S. employment report disappointed at the same time. {snip}

Source: FreeStockCharts.com

Globe and Mail ran an interesting article on January 11, 2014 titled “Why a lower loonie is (mostly) good for Canada.” {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 12, 2014. Click here to read the entire piece.)

Full disclosure: no positions