(This is an excerpt from an article I originally published on Seeking Alpha on January 2, 2014. Click here to read the entire piece.)

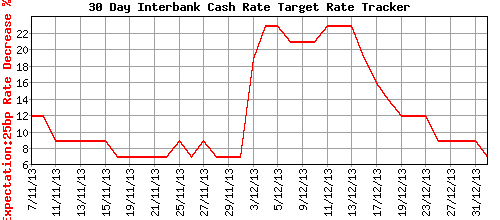

The ASX (Australian Stock Exchange) tracker for rate expectations dropped further to start the new year. The RBA (Reserve Bank of Australia) Rate Tracker dropped the odds of a rate decrease for the next meeting on monetary policy from 9 to 7%.

Source: ASX RBA Rate Tracker

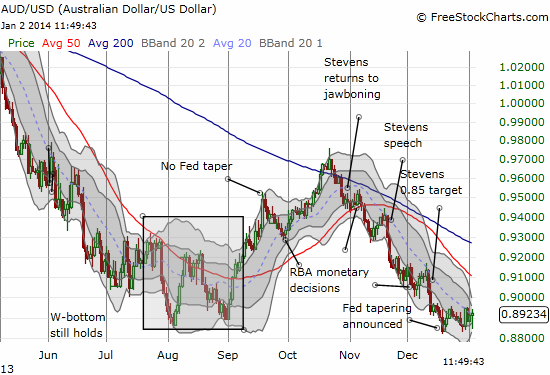

This decline in expectations should help firm up the Australian dollar (FXA) for at least the four weeks going into the February RBA meeting…{snip}

Source: FreeStockCharts.com

{snip}

The February RBA meeting will be another one of those closely watched central bank pronouncements. In particular, will the RBA come up with rhetoric and/or policy to back-up the 0.85 target that Stevens issued in mid-December? If not, the Australian dollar could rally right through the meeting.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 2, 2014. Click here to read the entire piece.)

Full disclosure: net long Australian dollar