(This is an excerpt from an article I originally published on Seeking Alpha on December 30, 2013. Click here to read the entire piece.)

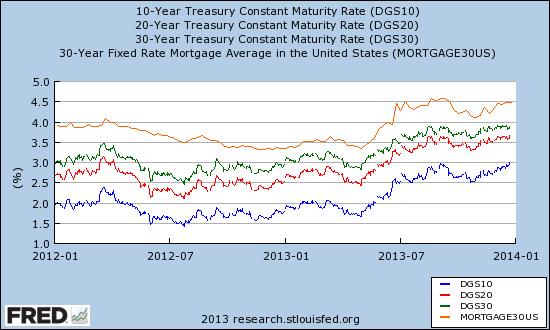

On Friday, the U.S. 10-year Treasury bond yield hit 3.0%, matching a high for the year. Rate are rising again across the yield curve.

Source: St. Louis Federal Reserve

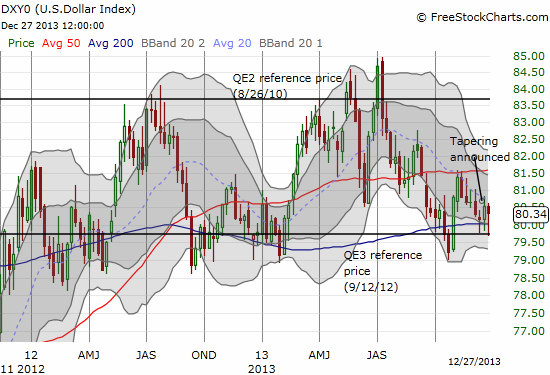

This steady march in rates should support a stronger U.S. dollar index (UUP). Yet, as the chart below shows, the U.S. dollar continues to hover just above its lows for the year. (Over the last three weeks, the U.S. dollar has managed to bounce off its QE3 reference price – the dollar’s level when the Federal Reserve announced QE3 last year).

Source for charts: FreeStockCharts.com

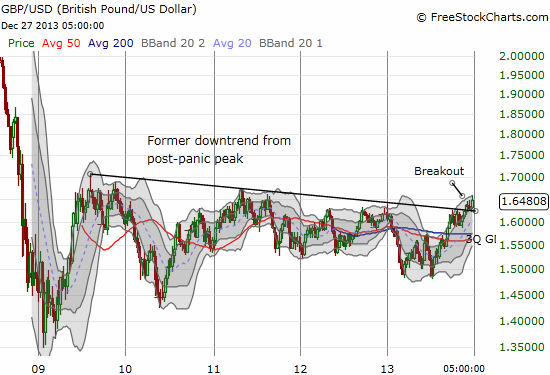

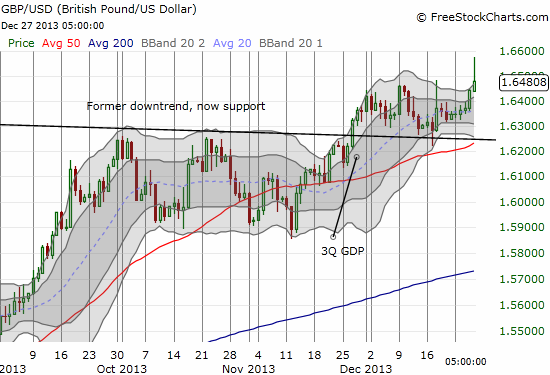

The British pound is one of the currencies in the index holding its own and then some against the U.S. dollar. I have spent many posts discussing my bullishness on the pound in reference to improving economic conditions. {snip}

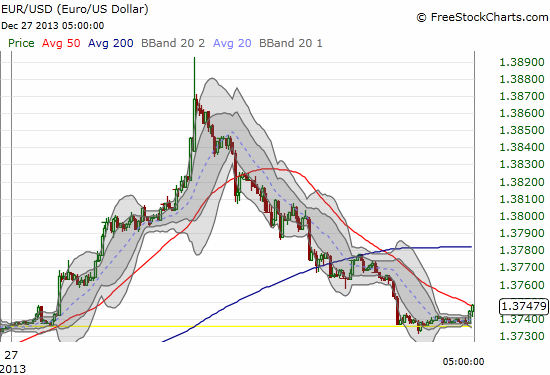

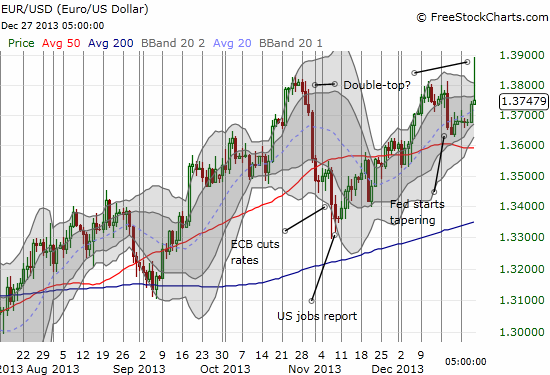

The euro (FXE) is the majority component of the U.S. dollar index. The economy and yield stories do not work so well for me when trying to digest the euro’s contribution to the dollar’s inability to lift-off toward the top of its multi-year trading range. {snip} I continue to think the euro is rising just as a general anti-dollar bet. That trade seemed to reach a pinnacle on Friday when the euro inexplicably surged against all major currencies. This move is seen most clearly in Friday’s action for the euro against the U.S. dollar.

{snip}

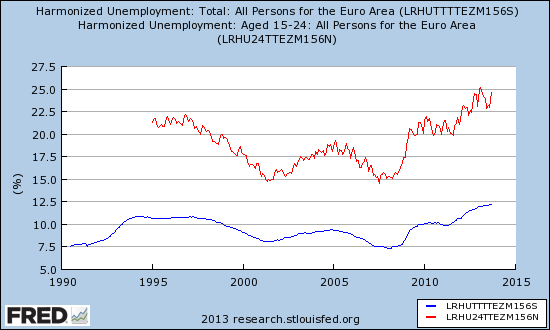

I continue to think short euro will be a strong trade to start 2014. The eurozone has a very unpleasant combination of rising unemployment AND high interest rates (in the periphery). {snip}

Source: St Louis Federal Reserve (updated through September, 2013)

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 30, 2013. Click here to read the entire piece.)

Full disclosure: short euro