There were no economic reports of importance from the eurozone or from the United Kingdom to end the week. Yet, this absence did not prevent traders from sending the euro (FXE) and the British pound (FXB) into major overnight breakouts: a 25-month high for the euro and 28-month high for the pound against the U.S. dollar (UUP).

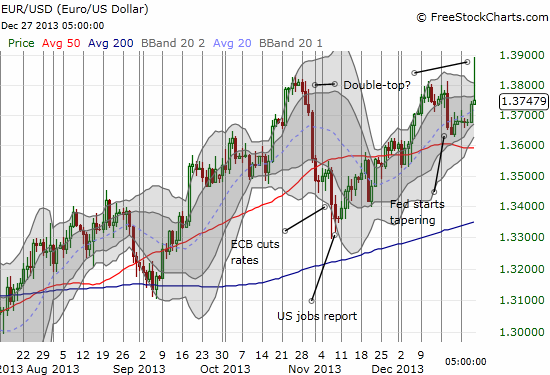

The surges hit major airpockets. In this post-holiday end-of-week, liquidity was likely very low. The strange surge happened conveniently ahead of U.S. trading hours, making it all the more likely U.S. traders would support a fade. In the end, the euro lost its entire breakout in what now looks like a complete fade and fakeout – what I believe is a confirmation of a double-top. This could turn into an important development for 2014. I wrote earlier that shorting the euro could turn into one of the more important trades in forex in early 2014. The ending to this week could be the early signal.

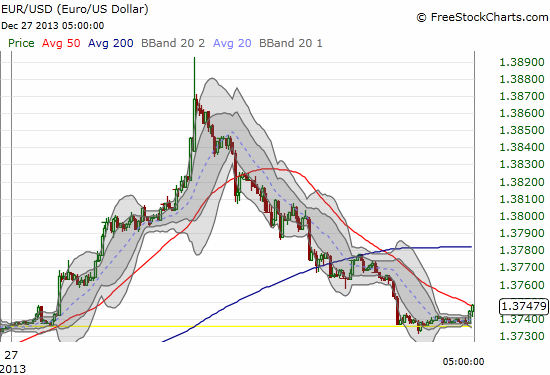

The first chart below shows the topsy-turvy EUR/USD action with the ECB rate cut initiating a recent bottom in the currency and Fed tapering producing just a momentary pause in the continued grind higher. The intra-day chart shows the extreme, sudden, and sharp nature of the run-up into the highs.

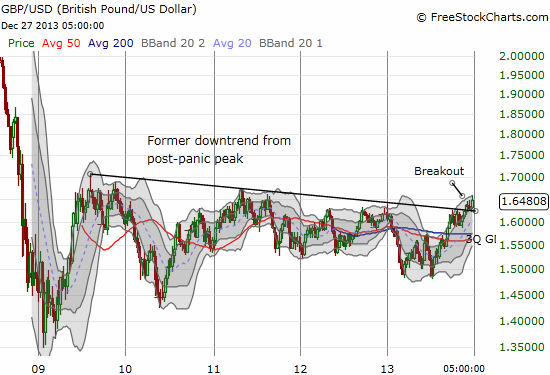

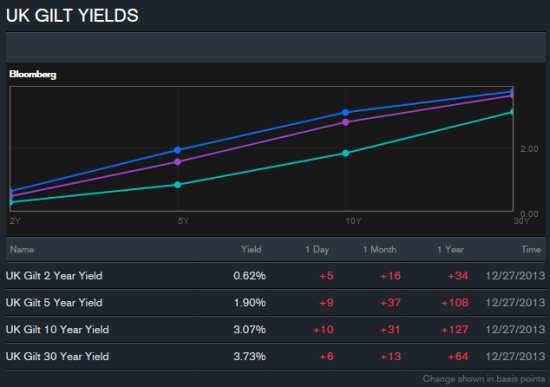

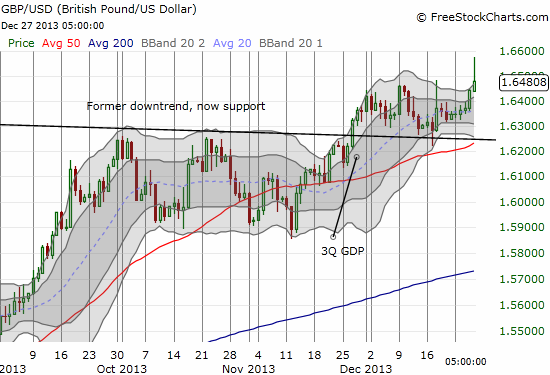

The British pound is clinging to its breakout and continues to find firm support from the former post-recession downtrend line. The potential differentiator for GBP/USD could be bond yields. The 10-year U.S. government bond yield hit 3.00% on Friday, but the British 10-year (gilts) hit 3.07%. I continue to like the pound over all the major currencies.

Source: Bloomberg

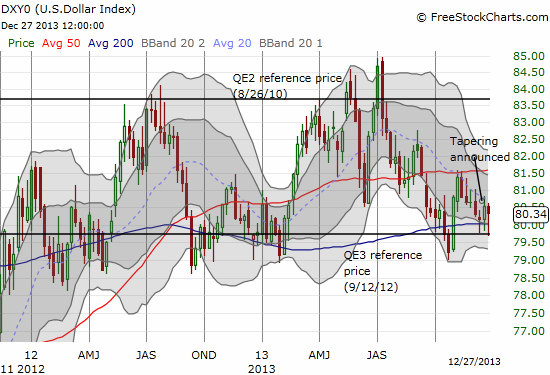

Another unusual, but perhaps not surprising, part of Friday’s action is that the dollar index as a whole bounced perfectly off its own support at the QE3 reference price (the index’s level when the Fed announced QE3 last year). This same support held after the index initially dropped in the wake of the Federal Reserve’s announcement that bond tapering would finally begin. Ever since then, the dollar has only “reluctantly” traded higher. Friday’s plunge is a reminder that there are plenty of traders who still prefer to bet against the dollar. Notice in the chart below the extremely minimal progress the dollar index has made after the Fed’s tapering announcement.

Source for charts: FreeStockCharts.com

I am surprised that the dollar index is not trading a lot higher than it is. The lack of “cooperation” is making my short-term bullishness on the dollar index waver a bit. While the euro is sending a potential trading signal for 2014, perhaps instead dollar sluggishness is the more important signal. As a result, I took the potential cue and added a little more to my precious metals holdings in gold (GLD), silver (SLV), and my favorite gold miner, Goldcorp (GG). My favorite silver miner, Pan American Silver (PAAS), has already run-up 10% this month, so I decided not to add to that position. (In forex, I will of course play the British pound against the U.S. dollar more aggressively if the dollar index does breakdown to start 2014). I will dedicate a future post to more details on the historic losing year for precious metals and implications for building long-term holdings.

Be careful out there!

Full disclosure: short euro; long GLD, SLV, GG, and PAAS.