(This is an excerpt from an article I originally published on Seeking Alpha on December 12, 2013. Click here to read the entire piece.)

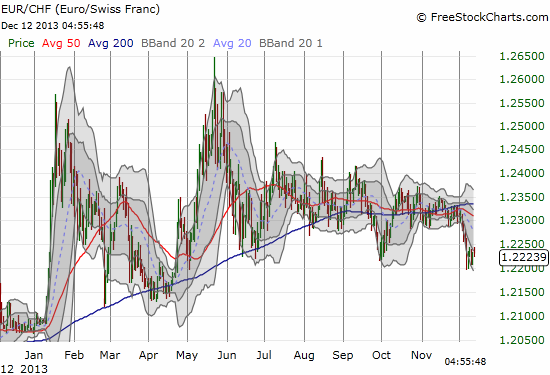

As expected, in its December monetary policy assessment, the Swiss National Bank (SNB) left its target range for the three-month Libor unchanged at 0.0 to 0.25% and reaffirmed its commitment to the 1.20 floor on EUR/CHF. As usual, the Swiss franc (FXF) barely responded to the announcement.

Two things stood out from the statement: a lowered forecast for inflation and several references to increased risks in financial markets.

{snip}

Note the change in focus now from market expectations of changes in monetary policy to actual changes. The SNB is essentially anticipating the impact of a first step toward normalization for U.S. monetary policy and the likely fall-out.

Missing from the September statement is the following outright warning in the December statement: “given the vulnerable economic situation abroad, downside risks still prevail for Switzerland.”

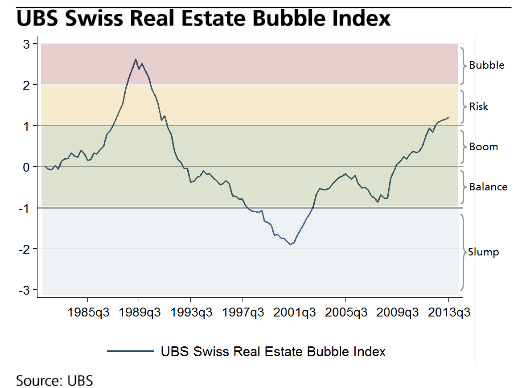

{snip} I interpret this to mean that risks in the real estate market have notably increased. Of course, part of the problem is that ultra low interest rates are facilitating increasing prices in an environment where the Swiss are probably more reluctant than usual to invest outside the country.

For additional context on Swiss real estate market, see the “UBS Swiss Real Estate Bubble Index.” For the third quarter, UBS increased its index from 1.15 to 1.20, placing the Swiss real estate market firmly in the lower portion of “risk” territory with the following observation: “Residential real estate prices and mortgage debt continued to grow much more strongly than economic output and household incomes. The risks have thus risen further.” The SNB seems to be confirming (or using?) the assessment from UBS.

{snip}

Source: UBS

{snip}

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 12, 2013. Click here to read the entire piece.)

Full disclosure: short Swiss franc, net short euro