(This is an excerpt from an article I originally published on Seeking Alpha on November 26, 2013. Click here to read the entire piece.)

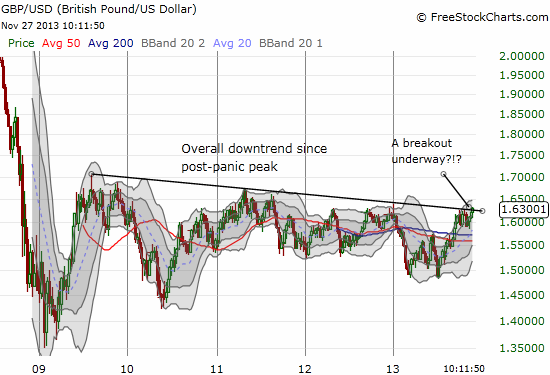

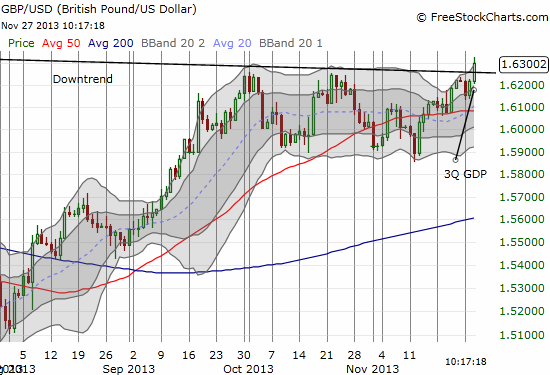

Third quarter GDP for the United Kingdom grew 1.5% year-over-year and 0.8% quarter-over-quarter. These numbers met economist “expectations,” yet the British pound soared in response anyway. This rally is important as it has taken the British pound (FXB) into breakout territory. While I have remained bullish on the pound for many months, I did not expect this line to get breached for quite some time yet.

Source: FreeStockCharts.com

Assuming no major setbacks in economic performance, this breakout could very well develop into a further extension of the on-going rally. {snip}

{snip} Exporters are not likely to get much relief as the Bank of England seems to have come to terms with a demand-driven recovery and a European trading partner whose demand remains too weak to boost UK export prospects in the near-term. {snip}

{snip}

Carney is looking at improving prospects for investment and demand as drivers of the economy. Since he is not relying on Europe, and the eurozone in particular, to provide tailwinds, the level of the British pound should also not be a center of attention. The pound is free to rise with little resistance from the Bank of England for now. {snip}

{snip}

I did not get a sense for how far spending growth can go on further reductions in precautionary spending. Obviously, at some point, real wage growth will need to take the baton from savings reductions in order for consumer spending to keep driving the economy as it is. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November 26, 2013. Click here to read the entire piece.)

Full disclosure: short GBP/AUD