(This is an excerpt from an article I originally published on Seeking Alpha on October 25, 2013. Click here to read the entire piece.)

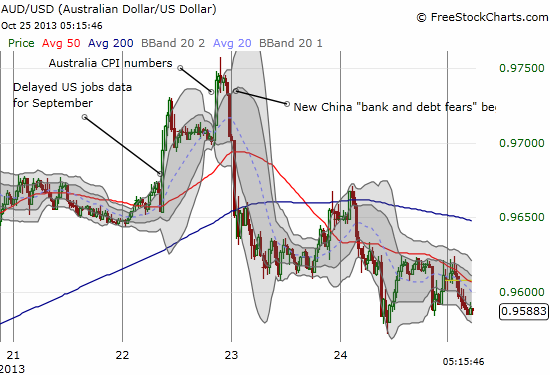

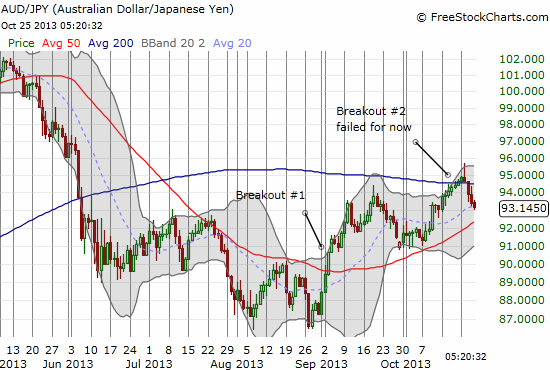

Ever since news of Chinese banks making massive write-offs and a parallel spike in China money rates stoked renewed fears over the Chinese financial system, the Australian dollar (FXA) has pared recent gains. I have used this opportunity to switch out of a net short to a small (I remain wary!) net long position as I indicated in the last post on the Australian dollar. Interestingly, futures traders are looking past the latest churn in China financial news and seem more focused on the slightly hotter than expected inflation numbers in Australia.

{snip}

{snip}

Source: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 25, 2013. Click here to read the entire piece.)

Full disclosure: net long Australian dollar