(This is an excerpt from an article I originally published on Seeking Alpha on September 6, 2013. Click here to read the entire piece.)

Homebuilders have claimed immunity from higher interest rates, and they are acting like it. Today (September 4th), Meritage Homes (MTH) and M.D.C. Holdings (MDC) announced their continuing expansion and investment in the housing market.

{snip}

Of course, these companies set these expansion plans in motion well before mortgage rates surged. These are plans that would get executed under almost any but the most disastrous circumstances. Analysts will certainly target these plans for questioning to determine absorption rates and assess whether the housing recovery remains intact. {snip}

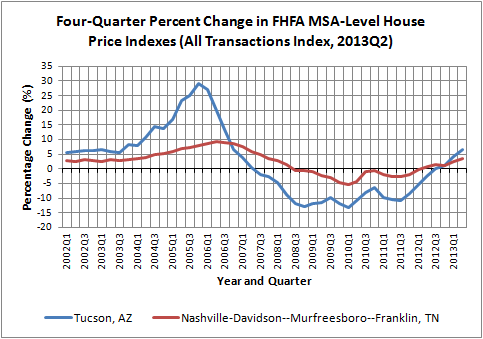

The year-over-year price change data from the Federal Housing Finance Authority (FHFA) shows that both the Tuscon and Nashville housing markets have only just recently returned to more normal levels of annual price appreciation. Nashville returned to positive territory in the second quarter of 2012; Tuscon just in the fourth quarter of last year. Tuscon has since been on a tear (relative to the collapse that preceded it).

Source: FHFA

{snip}

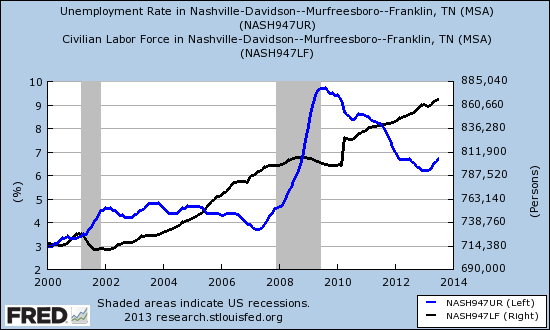

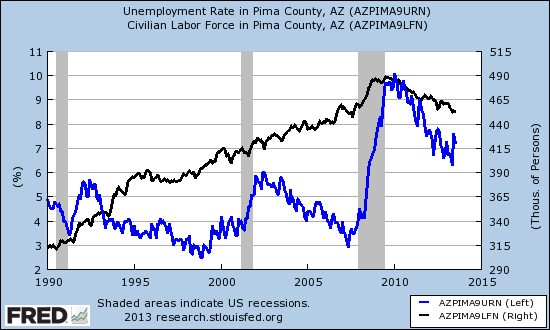

Job market dynamics may help explain the differences in the recoveries as well as describe the relative upside opportunities for each homebuilder with their respective acquisitions. {snip}

Source: St. Louis Federal Reserve

{snip}

Source: St. Louis Federal Reserve

{snip}

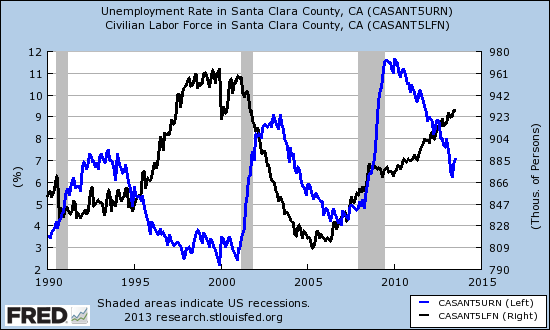

For comparison, here is the same chart for Santa Clara County where many tech companies are booming and housing prices in many areas have already recovered post-bubble losses and then some.

Source: St. Louis Federal Reserve

{snip}

Taking into account the relative job markets as well as the current price recoveries, I like Meritage’s expansion a lot better than MDC’s. {snip}

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 6, 2013. Click here to read the entire piece.)

Full disclosure: no positions