(This is an excerpt from an article I originally published on Seeking Alpha on August 20, 2013. Click here to read the entire piece.)

{snip}

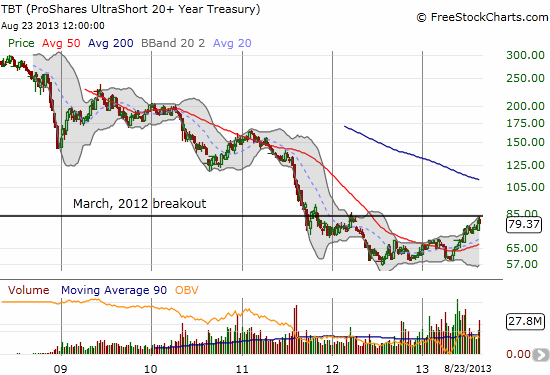

Back on March 14, 2012, I called a bottom for TBT that lasted all of a week. {snip} It is up 33% since the May 1st close. TBT has even climbed back to the point where the breakout occurred that convinced me a bottom was finally in.

Source: FreeStockCharts.com

I consider this overdue “vindication” quite tenuous. The fear of deflation that has given the Federal Reserve a free pass still runs thick. {snip}

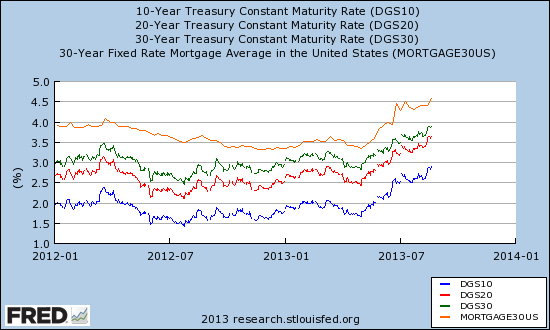

TBT may still be topped out for a while because the market seems to have very rapidly priced in an end to the Federal Reserve’s bond purchases even as the Fed has insisted it will remain accommodative well into 2015 (and beyond if warranted by inflation and jobs numbers). The Fed is far from raising short-term rates, and the threat of more interventions to manipulate long-term rates is always looming.

Source: St. Louis Federal Reserve

Going forward, it seems to me that a bet against bonds must remain a long-term bet. {snip}

On the other hand, the January 2015 put option with a $105 strike is up 49% year-to-date. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 20, 2013. Click here to read the entire piece.)

Full disclosure: long TBT