(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are highly gap down to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 36.6%

VIX Status: 15.0 (stopped short of important pivot)

General (Short-term) Trading Call: Hold. Aggressive traders should continue playing 50DMA breakout. Perhaps stop out on another lower close?

Active T2108 periods: Day #43 over 20% (overperiod), Day #7 under 40% (underperiod), Day #67 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar)

Commentary

I made one last check of market levels about an hour before the close and was satisfied that I could let my existing long positions continue to ride. It only took that final hour for all of Monday’s gains to fade into dust. Presumably, the market retreated on the prospect of the U.S. striking Syria.

The ugly fade left the S&P 500 with a close below its 50DMA again. This line is starting to look like a pivot point.

As long as uncertainty lingers about a potential expansion of the war in Syria, I can only guess the market will cling to this pivot. This prospect makes speculative long positions, especially in call options, very unattractive. I am looking to dump most of them into the next bounce. I will reset my perspective after that and/or a change in the macro/global headlines.

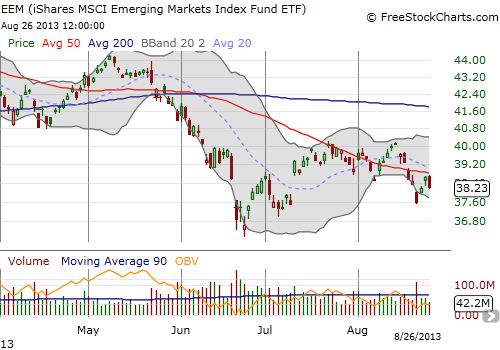

In the meantime, I did tweet a new bearish position with puts on EEM, the ETF for emerging markets. It struggled at 50DMA resistance and looked ripe for a fresh sell-off. I think any trader riding speculative long positions would do well to establish such hedges. They should work very well in the event of a sudden and abrupt sell-off on global headline turmoil.

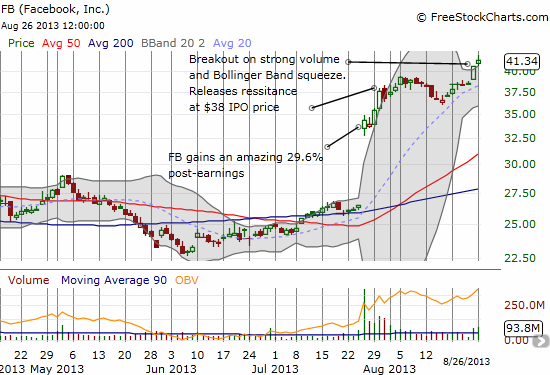

Facebook also made an impressive breakout on strong volume. Stubbornly, I added a second small tranche to my short position and bought call options to hedge. As I tweeted today, it is certainly possible that FB is about to barrel down the tracks like an out-of-control freight train, Tesla (TSLA) style. But I strongly suspect over some foreseeable horizon, say within a year, FB will be much lower than it is now. In the meantime, I will look to make as much money as I can riding call options against the short position (I got this idea from the last breakout where my hedge doubled in value overnight). Interestingly, the call options look very cheap to me for a stock that has the potential to ride to ever higher nosebleed valuations. Stay tuned for the details and travails on THIS trade. I think it could also be useful to provide a structure framework (aka a model) that could help guide trading from week-to-week.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SSO calls, long EEM puts, short FB and long FB calls