(This is an excerpt from an article I originally published on Seeking Alpha on August 20, 2013. Click here to read the entire piece.)

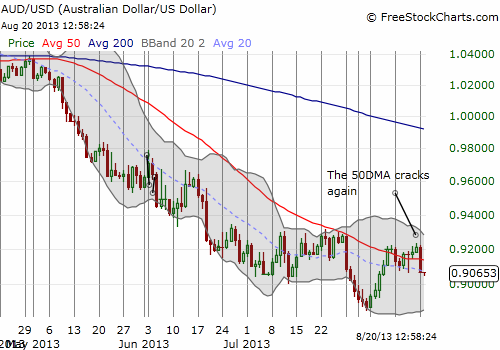

It was fun while it lasted. The anticipated relief rally in the Australian dollar (FXA) seems to have ended in parallel with the release of the meeting minutes from the last monetary policy meeting of the Reserve Bank of Australia (RBA). {snip}

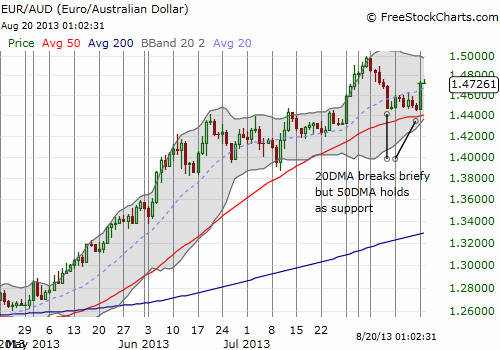

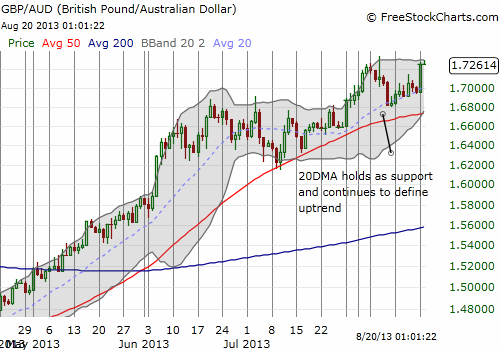

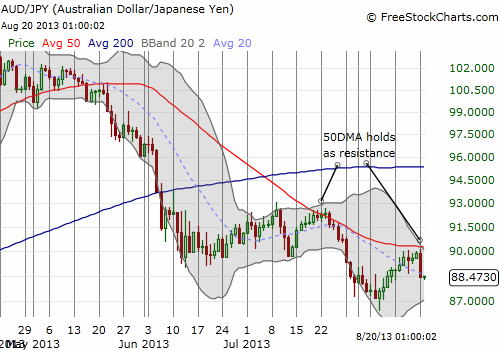

Source for charts: FreeStockCharts.com

Here are the nuggets I found of greatest interest from the minutes. I follow each one with my own editorial.

{snip}

“At recent meetings the Board had held the cash rate steady, but had judged that the inflation outlook might afford some scope to ease policy further, should that be necessary to support demand. The forecasts for this meeting suggested no lessening of that scope, but did show a weaker outlook for activity overall. The course of the exchange rate would be important. It had declined since the previous meeting, though remained high by historical standards. It was possible the exchange rate would decline further over time, which would assist in rebalancing growth in the economy, though it would also be affected by developments in other countries.”

This statement is probably as close the RBA will come to saying that it will keep lowering interest rates until the exchange rate gets down to an agreeable level. While I simply cannot see how even lower rates can be justified from here, I suppose anything is possible when major trading partners continue to pursue zero interest rate policies. Regardless, this statement is also enough to get me to switch back to a bearish bias on the Australian dollar, thus ending my ride on the relief rally.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 20, 2013. Click here to read the entire piece.)

Full disclosure: net short Australian dollar