(This is an excerpt from an article I originally published on Seeking Alpha on July 26, 2013. Click here to read the entire piece.)

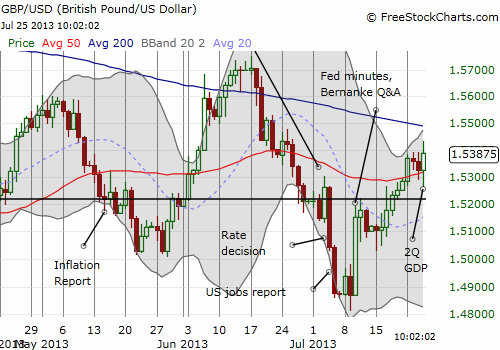

Second quarter GDP growth in the UK met “expectations” with a 0.6% gain over the first quarter and a 1.4% gain year-over-year. This is the first estimate and uses 44% of actual data.

The initial reaction was to sell the British pound (FXB). Presumably, expectations were high going into this report with a series of good economic data points in recent weeks, so meeting expectations triggered the obligatory contrary sell-off. However, the pound recovered all its losses in the U.S. trading session as the U.S. dollar fell across most major currency pairs.

{snip}Normally, I would conclude that the runway is now clear for further gains, but the next Bank of England Inflation Report is coming in two weeks. Fresh memories remain of new governor Mark Carney’s dovish talk after the last monetary policy decision where he called the rise in market rates at that time unwarranted by the economic data. {snip}

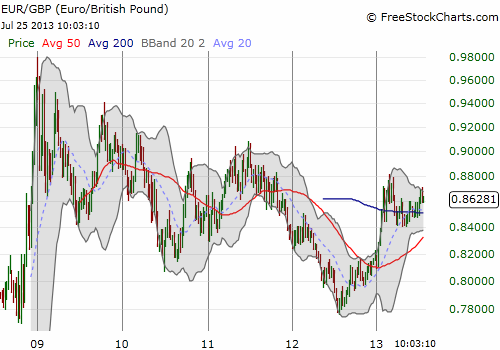

The most intriguing pair is the euro (FXE) versus the pound (EUR/GBP).

Source for charts: FreeStockCharts.com

{snip}

Manufacturing is one of two sectors (the other being construction) languishing the most in the UK economy. The eurozone is a major drag on UK manufacturing. Manufacturing is still 10% below its pre-recession level of output whereas services has essentially fully recovered. Manufacturing has declined consistently since late 2010, so its 0.4% growth in the second quarter is a small but encouraging sign of improvement.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 26, 2013. Click here to read the entire piece.)

Full disclosure: long GBP/USD