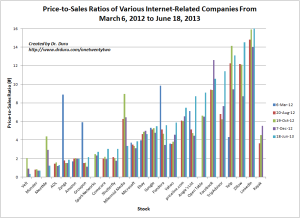

This post is a quick update on data that I maintain on price/sales (P/S) ratios on select internet stocks. I periodically refresh the data from Yahoo!Finance (semi-automated with links into a Microsoft Excel spreadsheet) and add the latest data to a chart. The chart is starting to get crowded so I may soon need to start dropping older series.

A few things have changed since the last update in December. Facebook (FB) has fallen from #2 to #5. Zillow (Z) has muscled its way to the #2 slot. Several stocks that already had high values (P/S above 6) have made large gains: Open Table (OPEN), TripAdvisor (TRIP), Yelp (YELP), and Zillow (Z). At the lower end, the most notable changes are the drops in MeetMe (MEET) and Milennial Media (MM). Velt (VELT) has plunged to dead last.

Many things have not changed. LinkedIn (LNKD) remains #1. Amazon’s (AMZN) valuation is unchanged (surprisingly). The crowded middle of internet stocks valued from 2 to 5 is just as crowded although some new members have entered the club: Comscore (SCOR) and Shutterfly (SFLY).

Overall, this group of stocks has done very well in 2013. Facebook is a notable exception hitting fresh lows for the year two weeks ago and trading down 8.9% year-to-date.

While I do not see any screaming values, I think this field of winners provides a ripe field for buying on dips. I am now particularly focused on Google (GOOG) (reported in my T2108 Updates). I am long overdue for an update on Groupon (GRPN). Way back in December, I identified it as a “January play.” It did well, and it continues to do well. The stock has long left a bottom behind, but I have yet to develop a new opinion on how far it can go. Note well that before December I was incredibly bearish on the company, to the point I was convinced it would not survive another year. ZNGA and MM are my disasters of the group. ZNGA in particular deserves a requiem in a blog post one day soon as one of my worst picks of last year. Finally, I have successfully traded in and out of stocks like OPEN, TRIP, Z, and Angie’s List (ANGI)…and wishing I never sold!

I have also traded in and out of FB, and I remain bearish (review archives of opinions on FB by clicking here). I finally closed out my large short position several weeks ago, but I still have a $20 target for this year. The clock is of course running out on that prediction. I have noticed that analysts have recently periodically upgraded FB and produced nice spikes. It is suggesting to me that going forward a workable strategy for bears is to fade these temporary spikes or for bulls to by FB AFTER a dip and a period of relatively quiet and calm…waiting for the next opportunistic pop. I of course prefer the former strategy.

Click image for a larger view…

Source of data: Yahoo!Finance

(Kayak was bought out in May. I left it in the chart but pushed it out to the far right. Otherwise, the stocks are sorted from left to right in ascending order of CURRENT price/sales).

Be careful out there!

Full disclosure: long YELP (call options), MM, ZNGA, MWW, YHOO; long P puts; long AMZN put spread likely to expire worthless this week; long FB puts