(This is an excerpt from an article I originally published on Seeking Alpha on April 17, 2013. Click here to read the entire piece.)

The U.S. core Consumer Price Index (CPI) increased 0.1% month-over-month in March as reported inflation continues to be mild. Housing is one industry that is no longer sticking to the script of no inflation. I last wrote about supply/demand imbalances in late February in “Supply/Demand Imbalances Continue Building In The Housing Market” and provided some data points demonstrating how price/cost pressures could be growing in the housing industry. I also showed how it is typical for the supply of homes to fall precipitously after a recession, likely causing the first sparks of price recovery as reviving demand begins chasing the reduced supply.

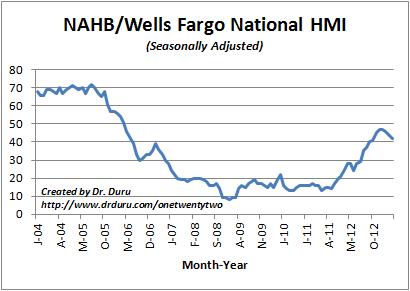

The National Association of Home Builders (NAHB) reported its Housing Market Index (HMI) for April, and it provided yet another data point demonstrating that builders are facing supply constraints and increasing costs. {snip}

{snip}

The chart below shows the HMI since 2004. {snip}

Source: NAHB/Wells Fargo Housing Market Index (HMI)

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 17, 2013. Click here to read the entire piece.)

Full disclosure: no positions