This is an excerpt from an article I originally published on Seeking Alpha on January 15, 2013. Click here to read the entire piece.)

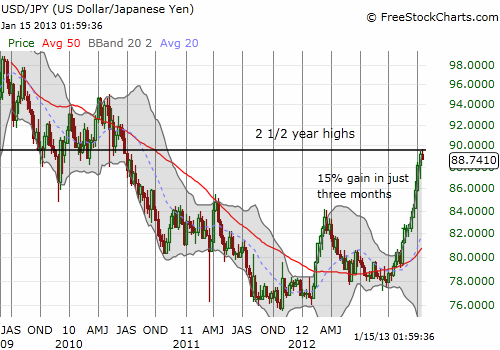

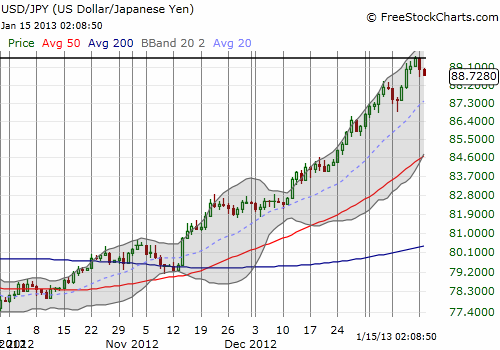

The Japanese yen (FXY) experienced a quick plunge after Akira Amari, Japanese economic and fiscal policy minister, expressed concern about the yen getting too weak. According to The Japan Times Online, Amari stated on television that he thinks USD/JPY at 89 is a “fairly good level” and triple digits would be excessive. Amari is apparently concerned that at some point soon the negative impact of higher import prices, like for fuel, will outweigh the benefits to exporters of the weaker yen.

Amari’s assessment hit the pause button on the yen. {snip}

{snip} Ultimately, Amari has given the market a “free range” from around 89 to 99 on USD/JPY although most analyst price targets I have seen peg USD/JPY around 90 for the year.

Source: FreeStockCharts.com

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on January 15, 2013. Click here to read the entire piece.)

Full disclosure: long USD/JPY