(This is an excerpt from an article I originally published on Seeking Alpha on December 21, 2012. Click here to read the entire piece.)

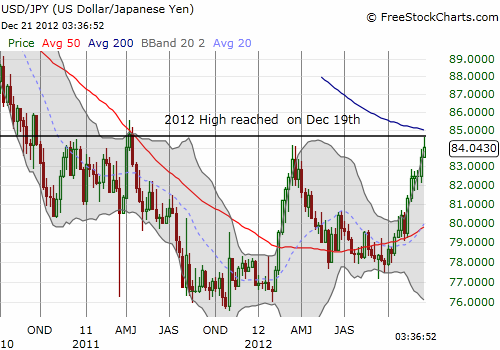

On December 20th, the Bank of Japan rolled out more stimulus and more accomodative monetary policy as expected:

{snip}

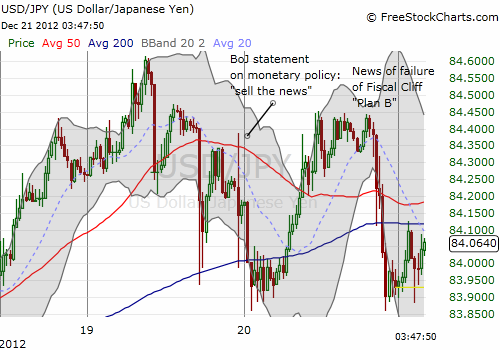

The Bank of Japan is clearly trying to get more aggressive in its efforts to fight deflation and reignite its economy. The effective increase in the availability in Japanese yen (FXY) may be arriving just in time for what could be a re-ignition of a rapacious appetite for yen as Fiscal Cliff negotiations in the U.S. apparently begin to sour.

{snip}

In typical fashion, the market went into “sell the news” mode (by strengthening the yen) in the immediate wake of the BoJ news. However, it was quite telling that the yen quickly reversed after this initial trigger reaction.

{snip}

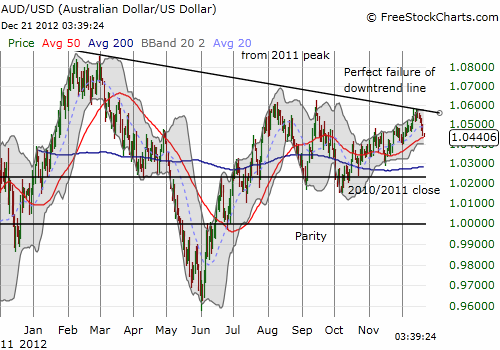

While the yen is likely to strengthen quickly, the Australian dollar (FXA) looks the most vulnerable to selling. {snip}

Source for charts: FreeStockCharts.com

Having said all that, I recognize that the Fiscal Cliff is steeped in political gamesmanship, so anything can happen at anytime. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 21, 2012. Click here to read the entire piece.)

Full disclosure: short AUD/USD