(This is an excerpt from an article I originally published on Seeking Alpha on December 8, 2012. Click here to read the entire piece.)

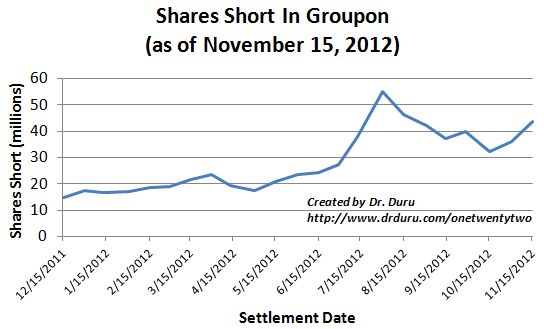

On November 8, 2012, Groupon (GRPN) reported earnings that disappointed the market. The following day the stock fell a stomach-churning 30% to fresh all-time lows. A week later, on November 15th, shares short GRPN settled 21% higher than levels on October 31st, producing short interest 21% of GRPN’s float. In just two more weeks, GRPN’s stock price surged 57%.

Source: NASDAQ.com short interest

This is the crowded theater into which someone (or some traders) yelled “fire” on Friday, December 7th with breathless rumors of Google (GOOG) potentially acquiring GRPN, sending GRPN to a 23% one-day gain. This rumor had enough meat on it to motivate Bloomberg TV to spend two and a half minutes discussing the prospects. {snip}

While rumors of an acquisition are questionable at best, there are other reasons to get bullish GRPN for at least the next month or so. {snip} This window of upside opportunity reverses my bearish opinions from March and April where I recommended that investors stay away from GRPN.

{snip}

Source: FreeStockCharts.com

GRPN is probably a stock that should never have gone public. This year has been a complete disaster. However, note the record volume surge in GRPN after its November earnings report. {snip}

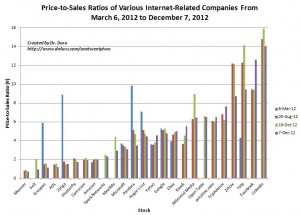

Click image for larger view…

Source: Data collected at select times from Yahoo!Finance

{snip}

The options trading in GRPN adds a final element of intrigue. {snip}

So while the occasional vicious rumor should continue to goose GRPN higher, there is plenty of additional/potential tinder laying around to send sparks flying: “bargain-hunting” for playing the January effect, a wash-out of motivated sellers, a likely extreme in negative sentiment, call option buying, and maybe even a short squeeze. At a bare minimum, I would not want to be short GRPN under the current circumstances. Instead, I will be looking for an opening (and an excuse) to get long GRPN.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 8, 2012. Click here to read the entire piece.)

Full disclosure: long AOL (calls), YHOO, and net short FB