(This is an excerpt from an article I originally published on Seeking Alpha on December 10, 2012. Click here to read the entire piece.)

For over three months, First Solar (FSLR) has benefited from a lack of bad news. When FLSR announced on August 30th that it would halt deliveries of solar panels to its massive Agua Caliente project, the stock tanked 18.7% in one day, ending a sharp rally ignited by earnings on August 1st. Construction at Agua Caliente was way ahead of schedule and the palpable concern at the time was that FSLR had pulled forward a lot of panel demand from future years into 2012 to meet near-term revenue and earnings targets. When I wrote three weeks later that FSLR’s rally was losing momentum, I figured that the stock would soon experience follow-through to that selling. It took another two weeks for the stock to trade back down to levels from August 30th, but the stock has yet to look back since.

{snip}

Source: FreeStockCharts.com

{snip}

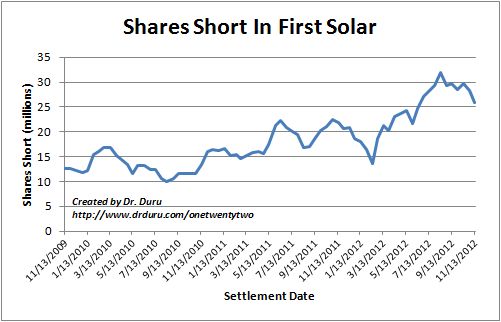

Source: NASDAQ.com short interest

With handwringing over Agua Caliente apparently left in the past, I took particular interest on November 15th when respected Maxim Group analyst Aaron Chew used FSLR’s last 10Q report to estimate that 2013 EPS and margin guidance will disappoint. {snip}

During the last earnings conference call, FSLR answered a pipeline-related question by stating that the company has recognized revenue on 626MW of its 3GW pipeline. I found it telling that no analyst directly asked about Agua Caliente. Instead, analysts were trying to get a handle on things like FSLR’s international mix of business, competition, margins, and the bankability of the backlog.

{snip}

I remain comfortable with my earlier assessments that FSLR is for now just a trading stock and that the best way to play the longer-term survival of the company is to sell long-term puts aka LEAPS (articles written in August and March respectively). {snip}

After scanning through the 10Q numbers that Chew used in his report, I decided to review the entire release. I did not find any smoking guns, but I did find some nuggets of interest that expanded upon info from the conference call. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 10, 2012. Click here to read the entire piece.)

Full disclosure: short FSLR puts, also long calls and puts