(This is an excerpt from an article I originally published on Seeking Alpha on December 3, 2012. Click here to read the entire piece.)

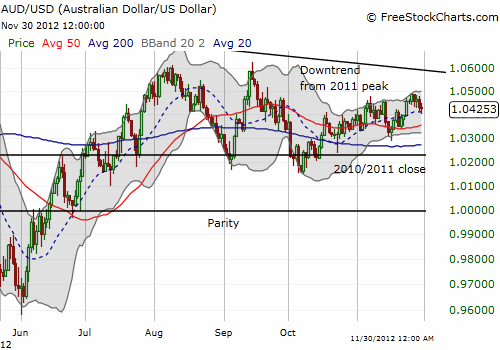

Analyst consensus anticipates a rate cut at the next meeting of the Reserve Bank of Australia (RBA). I forgive you for being surprised if you have been keeping your eye on the value of the Australian dollar (FXA). {snip}

Source: FreeStockCharts.com

On December 2nd (the 3rd in Australia), the Australia Bureau of Statistics reported disappointing October retail sales. Consensus forecast was for 0.4% growth but the actuals came out flat. {snip} While the weak retail sales could provide cover for an RBA cut, I still think any imminent cuts will be more motivated by a desire to weaken the currency than anything else.

For example, overall growth of retail sales in Australia remains as healthy as ever over the last 4+ years.

Source: Australia Bureau of Statistics, 8501.0 – Retail Trade, Australia, Oct 2012, Downloads

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 3, 2012. Click here to read the entire piece.)

Full disclosure: net short Australian dollar