This is an excerpt from an article I originally published on Seeking Alpha on November 5, 2012. Click here to read the entire piece.)

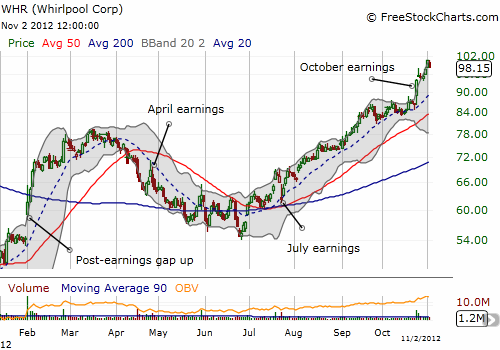

Back in February, I reviewed the latest earnings report from Whirlpool (WHR) and concluded that the stock still had upside but it was better to buy on a dip. {snip}

Source: FreeStockCharts.com

{snip}

I believe the main story for Whirlpool this year was margin expansion. {snip}

Next year’s story will have to be sales growth that leverages this margin expansion. This will require, for example, a continuation of the housing recovery in the U.S., stabilization in Europe, and continued strength in Brazil. {snip}

North America was over 50% of WHR’s revenue in the third quarter and over 70% of operating profit (note that I could not quite get the numbers in the earnings presentation to add up). Fortunately, WHR is “increasingly encouraged by leading demand indicators” in the U.S.:

- Consumer confidence

- Housing starts

- Rental market

WHR provided additional commentary on the U.S. housing market but nothing quantitative (from the transcript of the conference call provided by Seeking Alpha):

{snip}

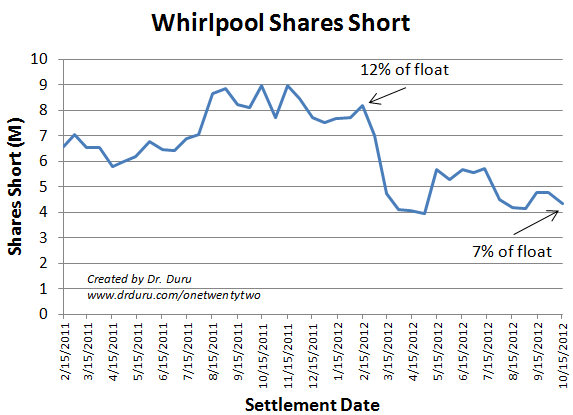

It turns out that my last piece on WHR was timed right at the recent height of short interest. {snip}

Source: NASDAQ short interest for WHR

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on November 5, 2012. Click here to read the entire piece.)

Full disclosure: no positions