This is an excerpt from an article I originally published on Seeking Alpha on November 17, 2012. Click here to read the entire piece.)

Zillow’s Q3 negative home equity report helps to shed more light on the underlying factors supporting the housing recovery. According to Zillow (Z):

“…high negative equity rates have contributed to appreciation, as they contribute to inventory shortages. Underwater homeowners cannot put their homes on the market because they couldn’t sell the house for enough to cover their outstanding mortgage, despite increased demand. Therefore, as the supply of homes is constricted, buyers are more likely to bid up prices in the market and therefore drive up home values.”

Demand for housing has been the trigger to set this dynamic in motion, and 2012 has been the year of a recovery in housing demand. {snip}

In addition to stronger demand, the ability and willingness of homeowners to continue payments on underwater homes have also contributed to the growing squeeze on inventory. {snip}

Altogether, these forces converged to drive up home values in the third quarter by the largest quarter-over-quarter increase since 2006…{snip}

When the housing bust was at its worst, there were a lot of fears that homeowners would abandon homes in droves, including through strategic defaults. This flood never happened and the latest data suggest such a flood is not imminent either. In fact, the next wave of supply will likely not come until prices increase enough to put a significant dent in negative equity. {snip}

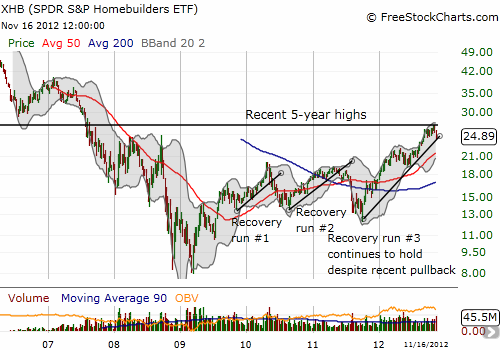

In the meantime, the SPDR S&P Homebuilders ETF (XHB) has already responded well to the improved prospects for housing. {snip}

Source: FreeStockCharts.com

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on November 17, 2012. Click here to read the entire piece.)

Full disclosure: no positions