This is an excerpt from an article I originally published on Seeking Alpha on November 14, 2012. Click here to read the entire piece.)

By now, news about the budding housing recovery should feel like very old news. However, I think it still makes sense to continue checking in with companies with front row seats to the housing market to confirm that positive momentum remains in the market. Home Depot (HD) reported earnings earlier this week (November 13th), raising earnings and revenue for FY12, partly as a result of a “healing housing market.” {snip}

The most encouraging sign is that the housing market is now a positive contributor to the growth of Home Depot’s business:

{snip}

I also took note of a comment from a Morgan Stanley analyst who claimed that household formation is increasing. Sure enough, growth in household formation is now at levels last seen in 2006. So, while growth is still well below the average from 1996 to 2006, the trend since the recession ended is pointing upward. {snip}

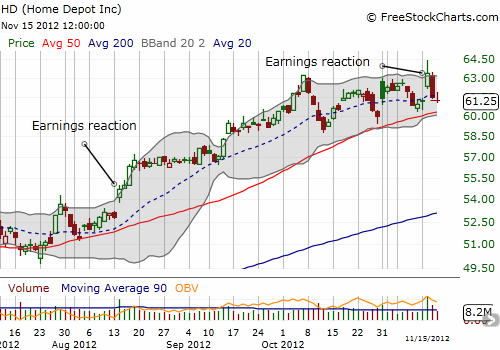

The stock market initially reacted to HD’s results very positively. {snip}

Overall, HD has had an incredible run in 2012 (along with many housing-related stocks), so a little consolidation at this point would be very healthy. HD has gained 46% year-to-date, well ahead of the S&P 500’s 7.6% year-to-date gain. As with so many other housing-related stocks, buying the dips continues to make sense to me.

Source for charts: FreeStockCharts.com

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on November 14, 2012. Click here to read the entire piece.)

Full disclosure: no positions