(This is an excerpt from an article I originally published on Seeking Alpha on October 26, 2012. Click here to read the entire piece.)

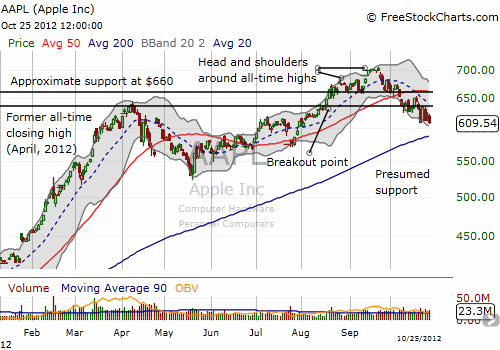

After Apple (AAPL) re-opened for after-hours, post-earnings trading, I could tell the reaction would be mild when the stock barely dropped below $600 and immediately bounced. {snip} Regardless, anywhere around current levels, AAPL looks like a good buy.

The flat close in after hours trading will likely lay waste to premiums on both the call and put side of the options ledger during Friday’s trading. This scenario is an options seller’s dream, but it is of course exactly the worst outcome for the hedged Apple earnings trade I described earlier. {snip}

{snip} My biggest lesson from this latest earnings trade is perhaps an ironic one, especially considering the success these methods have had this year. By enhancing (aka complicating) the template that relates post-earnings trading performance to historical price patterns with other signals like the put/call ratio, short interest, volatility, and extreme analyst bullishness, I diluted the simple and primary message from the data: the odds favored a modest move to the upside. {snip}

I also (re)learned an important lesson about risk-based positioning. {snip}

So what to do going forward? I will of course salvage what I can… {snip}

One key wildcard is the NASDAQ (QQQ). {snip}

Source for charts: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 26, 2012. Click here to read the entire piece.)

Long AAPL put spread, call, and call spread